If you’ve been watching the markets, you’ve likely felt the rollercoaster of economic shifts that have unfolded. From trade wars to heated debates about the size of the federal workforce, the first few months of the year have been anything but predictable.

- Market Rally Reverses

Just a few months ago, markets were surging on hopes of a business-friendly second Trump term. Investors were optimistic, expecting deregulation and tax cuts to fuel another bull run.

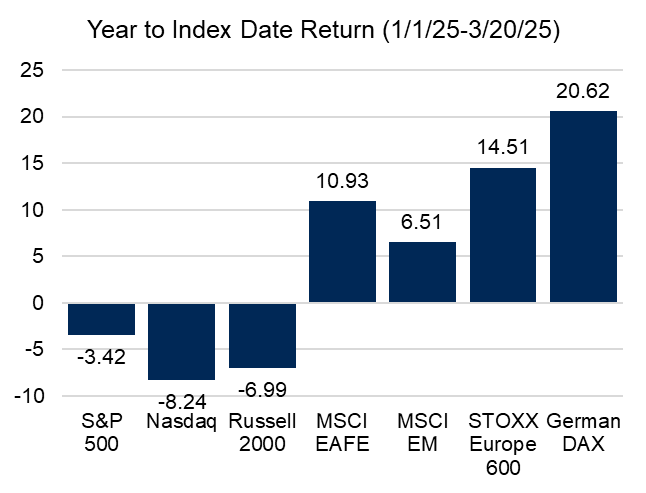

But that optimism has faded. Uncertainty around trade policy and growing recession fears have wiped out six months of gains. The market’s mood has shifted from excitement to caution. The hardest-hit sectors include financials, industrials, and small-cap stocks. These industries thrive in a pro-growth environment but struggle when uncertainty takes over.

The S&P 500 and Nasdaq have officially entered correction territory, sliding more than 10% from their recent highs. Global markets, especially in Europe, are holding up better, showing resilience amid U.S. turmoil.

Big takeaway: This is why diversification matters. Spreading investments across different sectors and regions helps soften the blow when markets turn volatile.

- Consumer Sentiment Is Dropping, and Inflation Isn’t Helping

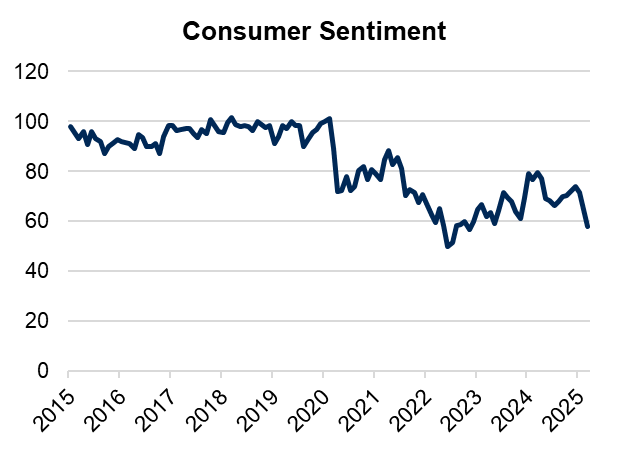

Americans are feeling the pinch. The Consumer Sentiment Index fell to 57.9, its lowest level since 2022, reflecting growing concerns about inflation, wages, and economic stability.

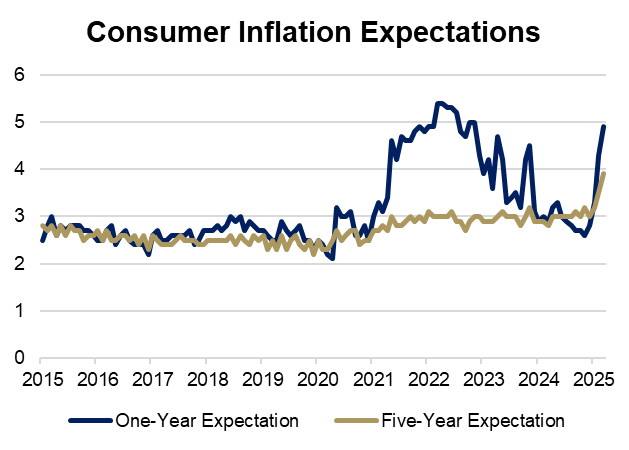

Adding to the worry, inflation expectations are climbing:

- One-year outlook: 4.9%, the highest since 2022.

- Five-year outlook: 3.9%, the highest since 1993.

When consumers expect prices to keep rising, they change their spending habits, which can slow economic growth. The Federal Reserve will be watching this data closely as it weighs future policy moves.

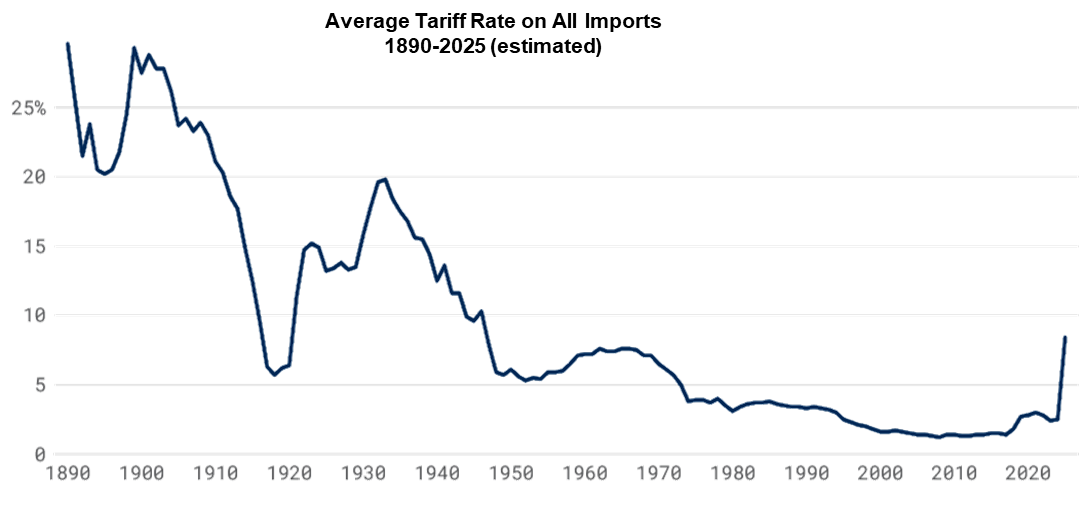

- Tariffs Are Back, and They’re Bigger Than Ever

The U.S. is on track for a major tariff hike, with import rates expected to rise from 2.5% to 8.4% by 2025. That would be the highest level since 1946.

Why does this matter? Higher tariffs mean:

- More expensive goods for businesses and consumers

- Disruptions in global supply chains

Retaliatory tariffs and measures from other nations

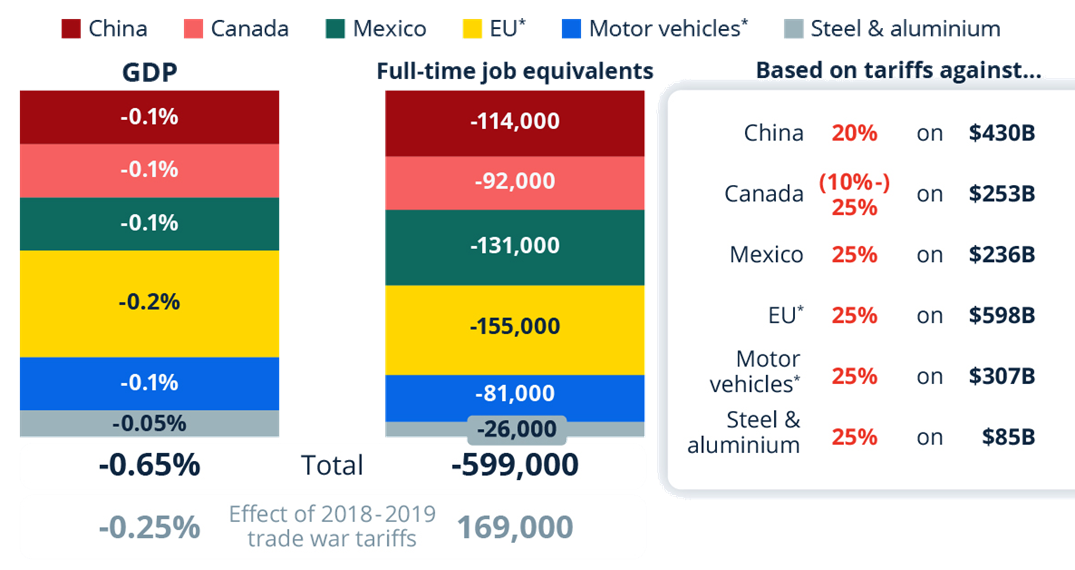

- The Cost of Tariffs: Jobs and the Economy

Tariffs don’t just raise prices—they reshape the economy. The Tax Foundation estimates these tariffs could:

- Shrink U.S. GDP by 0.65%

- Eliminate 600,000 full-time jobs

- Generate $229 to $263 billion in tariff revenue for the government by 2025

For comparison, the 2018–2019 trade war tariffs cut GDP by 0.25%, led to 170,000 job losses and increased household expenses by $300 to $600 per year. The impact this time could be even greater.

- Markets Hate Uncertainty, and We’re Getting a Lot of It

Markets thrive on stability, but right now, they’re getting anything but.

During the 2018–2019 U.S.-China trade war, the S&P 500 dropped 5% on major tariff announcement days. Similar volatility is likely this time.

- Short term: More market swings, sharp reversals, and unpredictable trading days

Medium term: Companies will face higher costs, weaker demand, and restructuring challenges as they adapt to new trade realities

- GDP and Job Market Trends

The Atlanta Fed expects U.S. GDP to shrink by 2.4% in Q1 2025. While GDP estimates can fluctuate, this forecast underscores the uncertainty surrounding U.S. trade policy.

One major factor? Companies are rushing to import goods before tariffs hit, causing a temporary trade imbalance. This type of distortion makes it harder to gauge the true state of the economy.

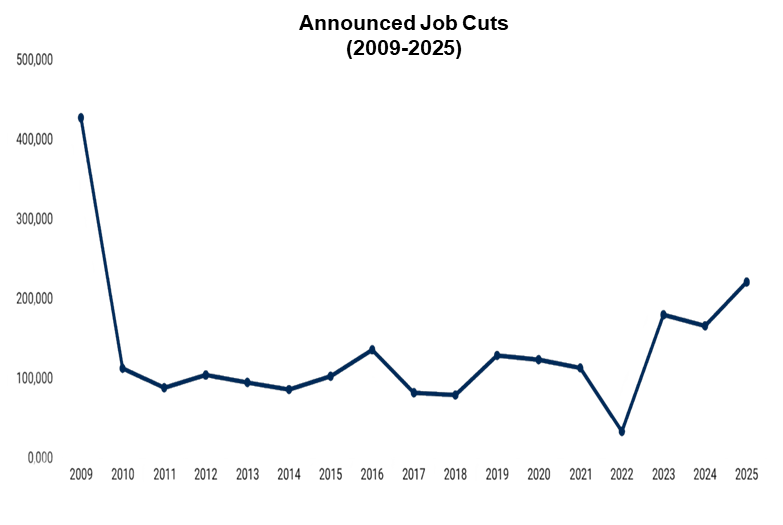

Meanwhile, layoffs are mounting:

- 221,812 job cuts so far in 2025, the highest year-to-date total since 2009

- 62,530 federal job cuts due to the Trump administration’s workforce restructuring

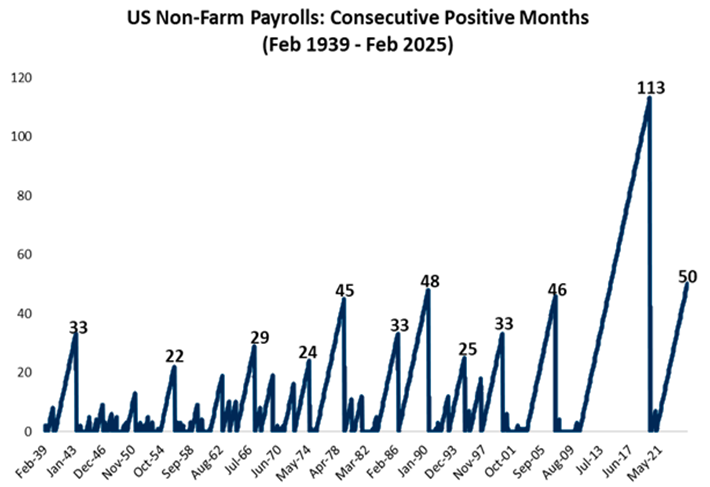

But there’s a silver lining. The U.S. still added 151,000 jobs in February, marking 50 straight months of job growth, the second-longest streak ever.

7. So, What Should Investors Do?

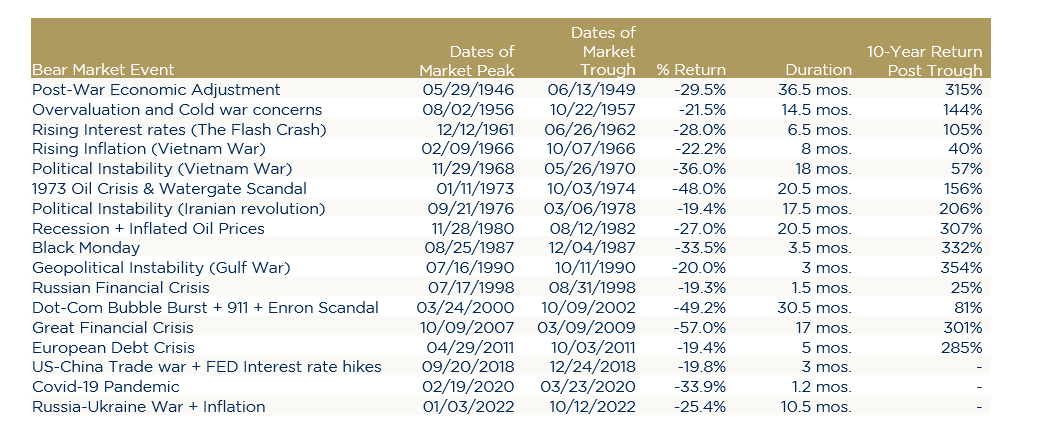

Trade wars, inflation, layoffs—there’s a lot of noise. It’s easy to panic, but history tells us something important.

Markets recover. Companies adjust. Economies adapt. Long-term investors tend to come out ahead.

The best move? Stay invested, stay patient, and if you can, take advantage of lower prices while others panic.

Pullbacks are normal – with a 10% correction happening on average once per year and a 20% bear market happening every 3-4 years.

Market volatility always feels uncomfortable in the moment, but seasoned investors know that downturns create opportunity.

As always, this, too, shall pass.

Fortress Team Member Highlight – Jay Rolfe

Where were you born?

Born in Fort Collins, CO

How do you like to spend your time outside of work?

Travel, spending time in North Carolina, reading, walking dog, Bible study

What is your favorite hobby?

Is golf considered a hobby?? If so, that would be it

What is the most memorable trip you’ve been on?

Cruise of the Greek Isles with my wife and son. Absolutely magnificent!

What did you want to be when you grew up?

A jazz musician

Are you a sports fan?

Yes; love college basketball and the Boston Celtics

How many different states have you lived in?

Three – Colorado, Oklahoma and Florida

If you could only eat one meal for the rest of your life, what would it be?

Pasta with home made noodles, salad, and fresh bread with Greek olive oil … topped off with a good bottle of wine!!

What was your first job?

First part-time job – as a proofreader at a Type shop while attending college. First full-time job – working for my Dad in the oil fields of Oklahoma

What would you do if you were gifted a million dollars with no strings attached?

Give to my Church; help my son pay off his mortgage; travel with my wife and son