If you’ve been watching the markets, you’ve likely felt the rollercoaster of economic shifts that have unfolded. From trade wars to heated debates about the size of the federal workforce, the first few months of…

Read More

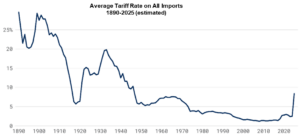

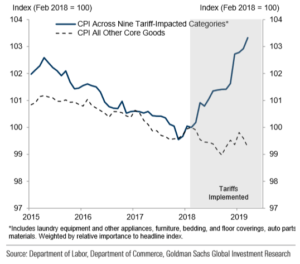

A Primer On Tariffs

With trade policy unsettling markets at the start of the second Trump administration, it’s important to understand tariffs—what they are, how they work, and the bigger economic and political effects they bring. While they can…

Read More

Year-In-Review | Fortress Wealth Planning

As we reflect on the past year, we are proud to share the growth our firm has experienced, a direct result of the trust and partnership we have built with each of you. Your confidence…

Read More

**Election Special** | Fortress Wealth Planning

As elections approach, speculation about their impact on financial markets intensifies. However, the election results are only one of many factors shaping market behavior, and short-term volatility often arises from a complex mix of economic…

Read More

June Newsletter | S&P 500 – an increasingly concentrated index

US equities have pleasantly surprised this year. Large-cap stocks in the US have shown impressive performance in 2024, particularly with the S&P 500 rising by nearly 15% since the beginning of the year (*as of…

Read More

Why Beating the S&P 500 Isn’t the Goal: Focusing on Your Investment Outcomes

Understanding the Limits of Index Comparisons In the financial industry, there is a pervasive focus on benchmark-relative performance, particularly against the S&P 500. However, there is little education about how indexes are constructed, and this…

Read More

Are Roth 401(k) Contributions Worth it?

Due to the SECURE Act 2.0 passed in 2023, more employers now allow employees to make Roth contributions to their retirement plans (401(k), 403(b), 457, SEP, SIMPLE, etc.). This change is driven by a new…

Read More

May 2024 Newsletter | Concentrated Stock Ownership Challenges

US equities have been exceeding expectations this year. The performance of US Large-cap stocks has largely been fantastic in 2024, with the S&P 500 up almost 10% since the start of the year (*as of…

Read More

Embracing Diversification in a Tech-Dominated Market

The recent surge in the S&P 500 index has undoubtedly caught the attention of investors worldwide, presenting an image of robust market performance. While the overall index may seem to indicate broad-based growth, a closer…

Read More

Why Diversify When Money Market Funds Are Paying 5%?

With money market funds currently offering a substantial 5% yield and the increased level of volatility in the stock market, it’s natural to question the necessity of diversifying into other asset classes. We certainly recommend…

Read More