Cryptocurrencies continue to generate headlines and questions. This article takes a closer look at digital assets, specifically through the lens of investment strategy: how they fit (or don’t) within a well-diversified portfolio.

The investment world has evolved rapidly over the past few decades, and it’s safe to say that evolution isn’t slowing down. As new opportunities emerge, it’s tempting to chase the next big thing. But just because something is new doesn’t automatically mean it belongs in a portfolio. Before any investment is added, it needs to serve a purpose—primarily by either helping to improve long-term returns or manage risk more effectively.

The Return Argument

Buying something because a neighbor or friend did might help ease short-term FOMO, but it’s not a sound investment strategy. Many of us grew up hearing something along the lines of, “If your friend jumped into a fire, would you do it too?” That sentiment holds true in investing.

As fiduciaries, we don’t recommend an asset class unless we’ve done the necessary research and understand what’s beneath the surface. With stocks, we know we’re buying into ownership of real businesses with future cash flow potential. Bonds come with contractual obligations for interest payments. These assets have long histories, measurable risks, and well-understood behavior patterns.

Newer assets like crypto don’t offer the same level of data. Limited track records make it harder to identify how they perform across different market environments. That doesn’t mean they’re without merit, but it does mean more caution is warranted.

The Risk Side of the Equation

Diversification is often cited as the reason to consider something like crypto, but true diversification isn’t just about adding more investments. It’s about adding the right kind—those that don’t move in lockstep with everything else in the portfolio.

An asset that brings more volatility than stability, or one that adds complexity without clear benefit, may end up doing more harm than good. The real test is whether it expands the portfolio’s opportunity set in a way that’s both intentional and beneficial.

Bitcoin

Bitcoin likely wouldn’t command the attention it does today if not for its dramatic price increases over the past several years. Yet the case for holding it as a long-term investment remains uncertain. Unlike stocks, it doesn’t provide ownership in a company or a share of future profits. Unlike bonds, it doesn’t offer contractual interest payments. Any potential return from holding bitcoin hinges entirely on someone else being willing to pay more for it in the future, a hallmark of speculative investing.

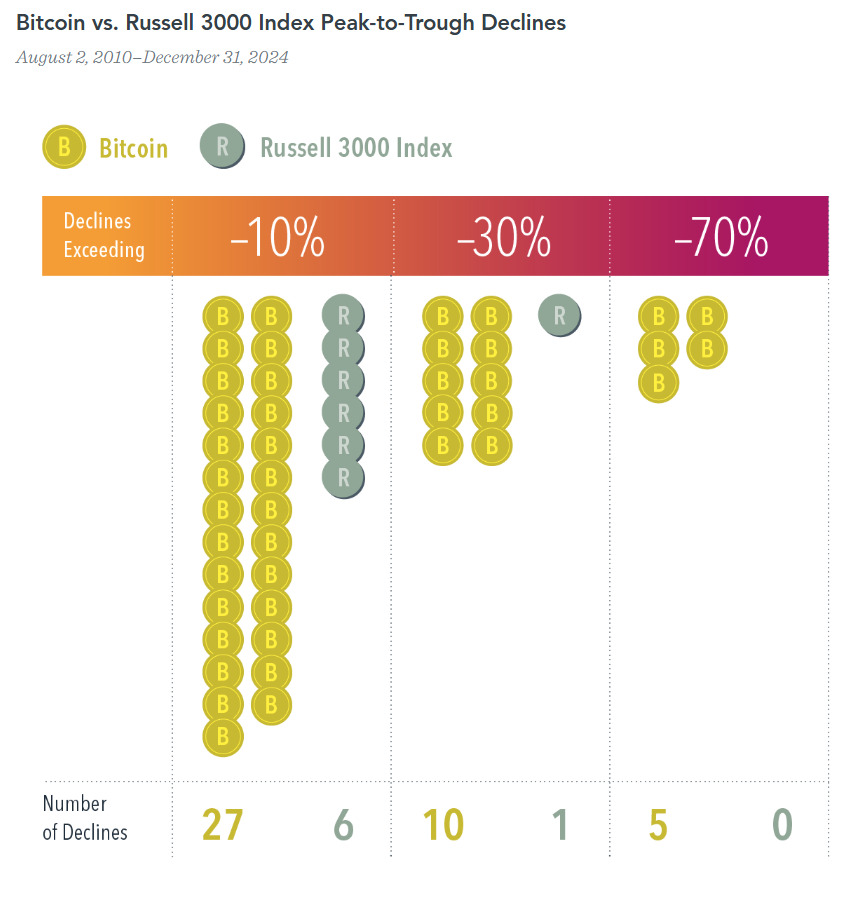

Over the past decade, Bitcoin’s annualized volatility has been nearly five times higher than that of the Russell 3000 Index—76.9% compared to 15.8%. Since its first recorded market price in August 2010, Bitcoin has taken investors on a volatile ride, with 27 peak-to-trough declines exceeding 10%, 10 declines exceeding 30%, and five declines exceeding 70% (Source: Dimensional Fund Advisors).

**The Russell 3000 Index is a market cap-weighted stock market index that seeks to be a benchmark of the entire U.S. stock market.

Bitcoin as a Store of Value

Bitcoin is often talked about as a digital way to store value—something you can hold onto and use later. But for something to truly work as a savings tool, it needs to be reliable. That’s where Bitcoin’s volatility raises concerns. Its value can swing wildly in a short period of time, making it hard to trust as a stable place to park money for the future. A dependable store of wealth shouldn’t feel like a rollercoaster.

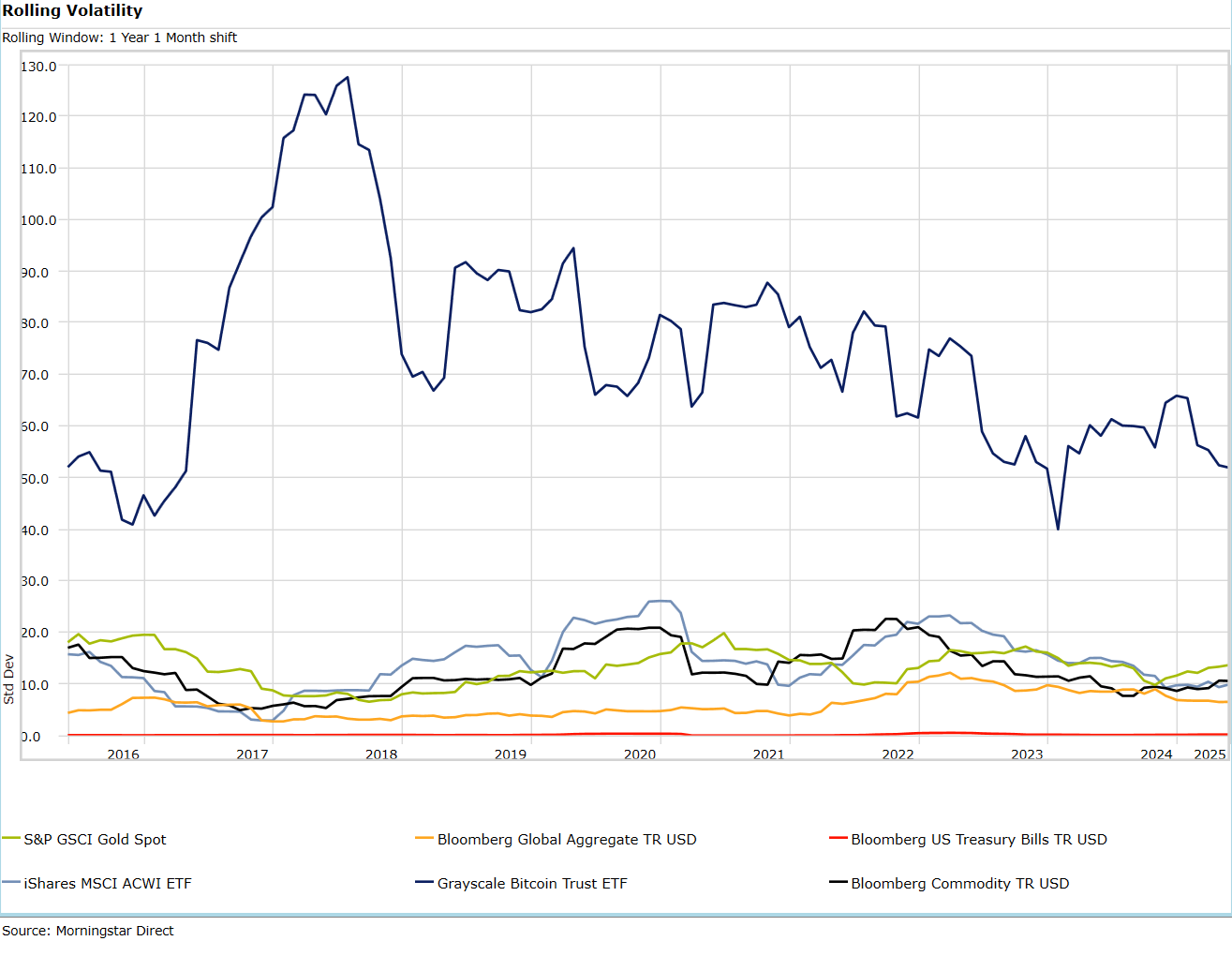

As shown in the chart below, from 6/1/2015 to 5/31/2025, Bitcoin (Grayscale Bitcoin Trust) experienced significant swings in one-year rolling volatility—far exceeding those seen in major asset classes like gold (S&P GSCI Gold Spot), global bonds (Bloomberg Global Aggregate), U.S. Treasuries (Bloomberg U.S. Treasury Bills), global equities (iShares MSCI ACWI), and broad commodities (Bloomberg Commodity Index).

As Fiduciary advisors, our responsibility is to make decisions with care and discipline in the best interests of those who entrust us with their life savings. The investment landscape will continue to evolve, and it’s reasonable to expect that cryptocurrencies will as well. But for now, given the speculative nature of crypto and the lack of fundamental underpinnings, we are not including such investments in our managed portfolios. Our focus remains on building strategies grounded in evidence, designed to serve long-term goals with clarity and purpose, with an individual Financial Plan driving our recommendations.