During our regular Spring and Fall progress meetings, current events often shape the questions that come up in conversation. This Fall, we’ve been hearing variations of the same questions: “Markets have been strong—are we due for a pullback?” and “Markets have been strong—should we be taking more risk?”

These are thoughtful questions, and we approach them with a mix of historical perspective and research. But what really stands out isn’t just the questions themselves, it’s the feeling behind them. It’s only natural to wonder when good times might give way to something less comfortable, and just as natural to see growth in the markets and wonder if there’s more to capture. Our purpose as financial planners is to guide thoughtful use of our clients’ resources while maintaining the stability and confidence needed to rest easy at night.

That balance between opportunity and comfort isn’t determined by numbers alone. It’s shaped by each person’s tolerance for risk, their preferences, and their experiences. Investing, after all, is part science and part art. While data and models can guide decisions, the human elements of reactions, patience, and discipline often play a bigger role in long-term success.

What Does Risk Mean to You?

Risk means different things to different people. In fact, it’s rare to see two people share identical comfort levels when it comes to investing their life savings. One person might see risk as the chance of losing money, while another might see it as the opportunity cost of not investing enough.

These differences aren’t just about numbers on a statement—they’re rooted in how we each experience the world. Past investing experiences, career paths, family backgrounds, and personality traits all shape how we feel when markets rise and fall. Some people are naturally more comfortable with uncertainty; others value stability above all else.

Staying aware of our own comfort level with risk helps keep investment choices on track toward long-term goals, even when markets test our resolve.

The Art: Behavior and Perception of Risk

Where human nature enters the equation.

When people think about risk, it’s often very different from what the numbers actually show. Statistically, risk can be measured in terms of probabilities, standard deviations, or percentage changes, but our brains don’t always process it that way. Humans tend to focus on the impact rather than the likelihood. A 10% drop in the stock market might feel terrifying if it occurs suddenly, even though such swings are fairly common historically.

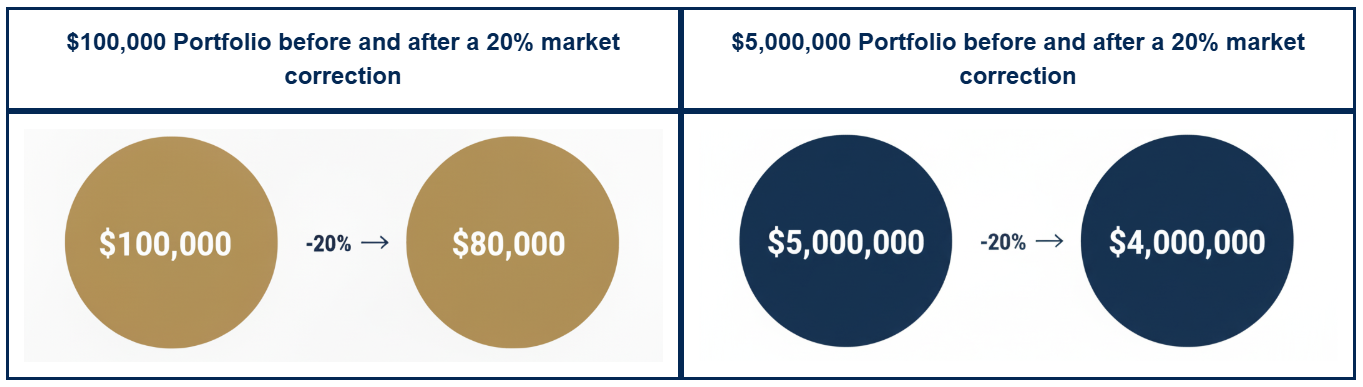

Human nature kicks in strongly when the nominal dollar impact is relatively large for a given investor. Two portfolios might both decrease by 20%, but the one with a higher market value will likely feel like a much bigger “loss,” even though the actual percentage drop is the same. A simple example of this is shown below, where a 20% decrease occurs in two portfolios of different sizes. Picture yourself in the position of the two investors shown below. Which one likely feels worse? Behaviorally, bigger numbers trigger bigger emotions.

Building a Framework For Success

The investment strategy should always start with the Financial Plan. Rather than relying on generic risk questionnaires or preset investment portfolios, our goal is to gain an understanding of the individual’s full financial picture. Priorities, resources, and long-term goals all play a part in determining the level of risk needed in the portfolio to support the financial plan it’s meant to achieve.

Understanding someone’s comfort level with risk is a key part of building the right investment strategy. It can be tempting to focus on the long-term returns of an all-stock portfolio, but if the ups and downs along the way cause enough stress to trigger a panic sell during a downturn, that strategy clearly wasn’t the right fit. We have seen this story unfold at times over our careers, and it can be devastating, wiping out years of progress and often leaving a lasting mark on someone’s financial life. The optimal portfolio is one you can stay with through every market cycle, helping you achieve your financial goals and live your “best financial life!”

Simple “Tools” to encourage investment discipline:

|