Wow — 2025 flew by. It was a year that felt like one major headline after another, keeping markets on their toes. Despite the ups and downs, the year wrapped up with strong results across many asset classes.

At Fortress Wealth Planning, we are grateful to mark nine years as an independent firm! We sincerely appreciate the trust reflected through referrals and the strength of our long-standing relationships.

Capital Market Returns 2025

2025 served as a good reminder of why diversification remains a cornerstone of long-term investing. International equities delivered robust returns and outpaced U.S. stocks by a wide margin, benefiting from more attractive starting valuations, continued uncertainty around U.S. trade policy, increased commitments to defense spending, and a weaker U.S. dollar. These forces created a favorable backdrop for non-U.S. markets after several years of relative underperformance.

At the same time, U.S. large-cap stocks continued to advance, driven by enthusiasm around artificial intelligence, resilient corporate earnings, and a gradual easing in interest-rates. While performance remained concentrated in certain growth areas, diversified exposure across regions allowed our portfolios to participate in these gains without relying on any single market or theme.

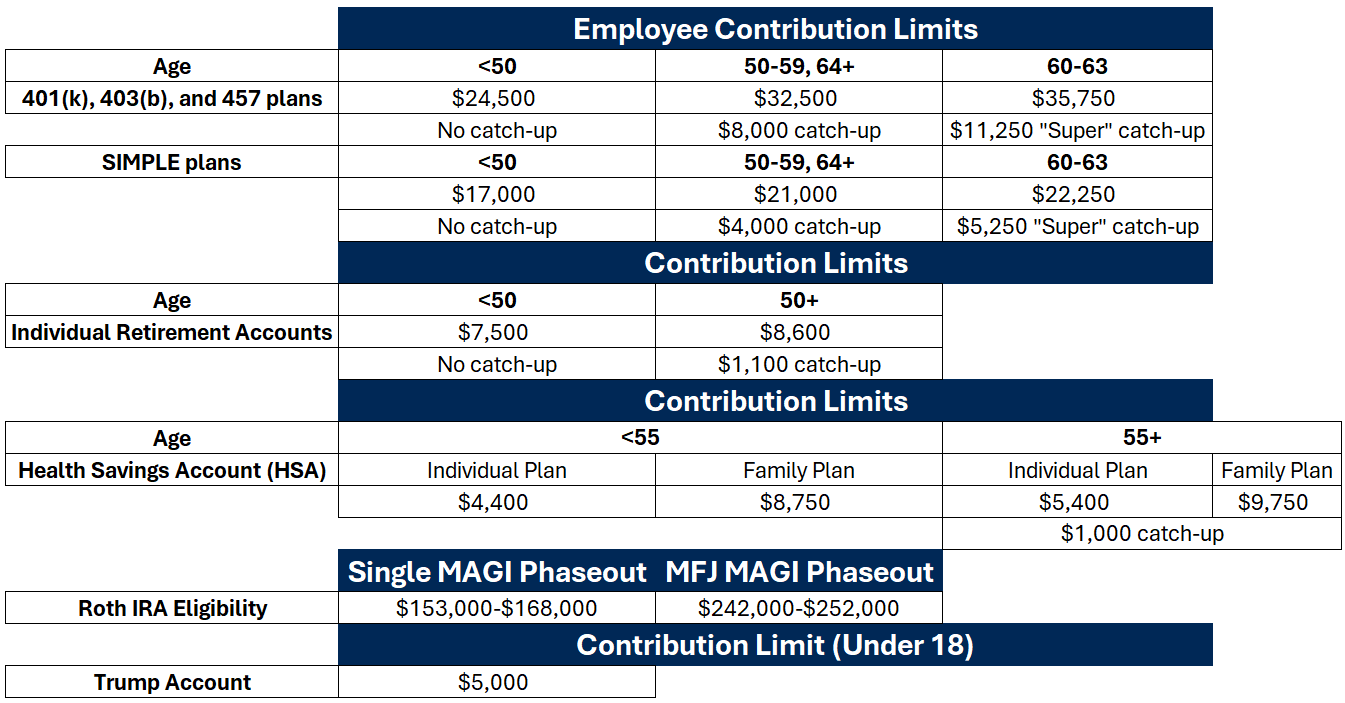

Retirement Contribution Limits in 2026

The IRS has released updated guidance on retirement contribution limits for 2026. The new limits are outlined below and may present an opportunity to save even more toward long-term goals. If maximizing retirement savings is a priority, consider reviewing current contribution levels and increasing them where possible to take full advantage of the updated limits.