One of the most common questions clients have as artificial intelligence continues to gain momentum is how to take advantage of it within their portfolio.

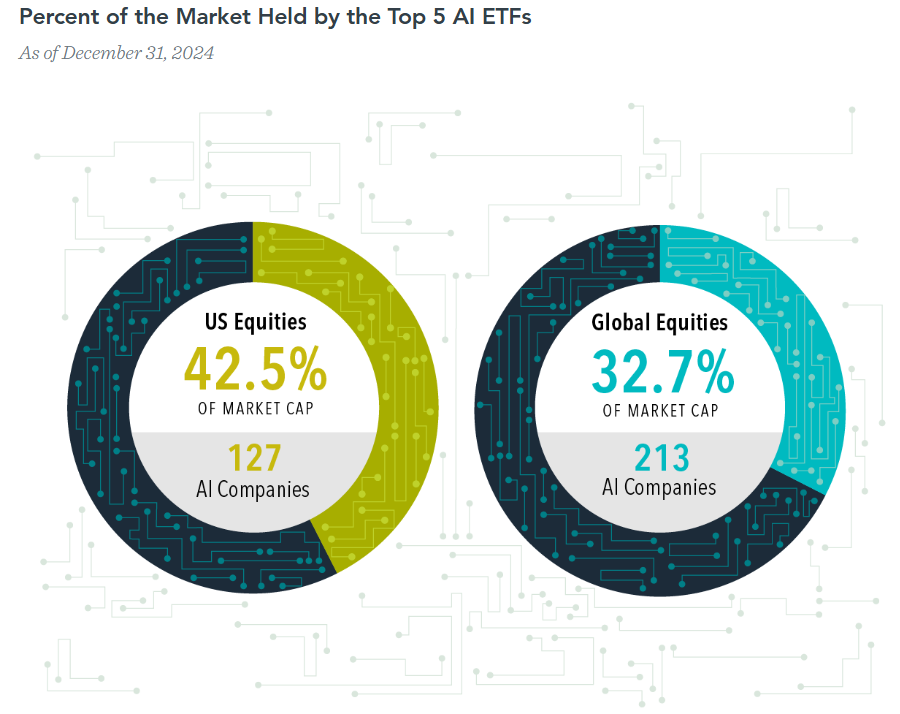

Many investors are surprised to learn that it can actually be more difficult to avoid exposure to so-called “AI investments” than it is to already have money allocated to them. This is largely because AI-focused strategies now represent a meaningful share of the U.S. equity market, with approximately 42.5% of the US stock market collectively held across 127 AI-oriented strategies, making AI exposure far more widespread than many realize.

Exposure to these types of companies extends beyond well-known technology leaders such as Nvidia, Google, and Apple. Many industrial, manufacturing, and defense firms, including companies like Caterpillar, Honeywell, and Lockheed Martin, are also leveraging AI across their operations.

The encouraging news is that a diversified portfolio likely already contains exposure to artificial intelligence, as tools and technologies are embedded across a range of industries, NOT just within a small group of headline-grabbing companies.

While the potential of artificial intelligence is exciting, its long-term impact is still a work in progress.

Just as we saw with the early days of the internet, not every idea will pan out, and the most valuable uses will ultimately be determined by how businesses and consumers choose to adopt the technology. Over time, the internet found its footing and went on to transform how we work, shop, and communicate. AI may follow a similar path, with practical, market-driven applications shaping its role in the economy.