As we enter the final weeks of summer, we wanted to share a concise update on eight key themes we’re currently focusing on in the financial markets, along with the strategies we’re implementing as we approach the final quarter of 2024.

- Interest rates – The market is currently pricing in an expected rate cut of 0.25%- 0.50%.

The current state of the yield curve reflects a complex economic environment. Typically, the yield curve, which plots the yields of bonds with varying maturities, slopes upward, indicating that longer-term bonds offer higher yields than shorter-term ones due to the risks associated with time. However, in the present scenario, the curve has shown signs of flattening and even inverting at times. This inversion is driven by factors such as central bank monetary policies, inflation expectations, and global economic uncertainties, leading to heightened market volatility and cautious investor sentiment.

An inverted yield curve has historically been a relatively reliable indicator of a potential recession, though it has not always been accurate. Currently, indicators such as unemployment, GDP, and consumer spending reflect traditionally “healthy” levels, giving us reason for cautious optimism that a recession may be avoided, though it remains a possibility. Further concerns regarding this are discussed below.

- Consumers appear to be feeling the effects of higher interest rates, a prolonged inflationary environment, and a tightening job market.

The M1 Money Supply data below offers an estimate of the current liquid assets held by consumers at commercial banks. As of July 2024, the reported amount was around $18 trillion, similar to levels seen in January 2021. Since peaking in April 2022, the M1 Money Supply has steadily declined. This trend aligns with the Federal Reserve’s tighter monetary policy aimed at reducing the amount of currency in circulation to combat inflation.

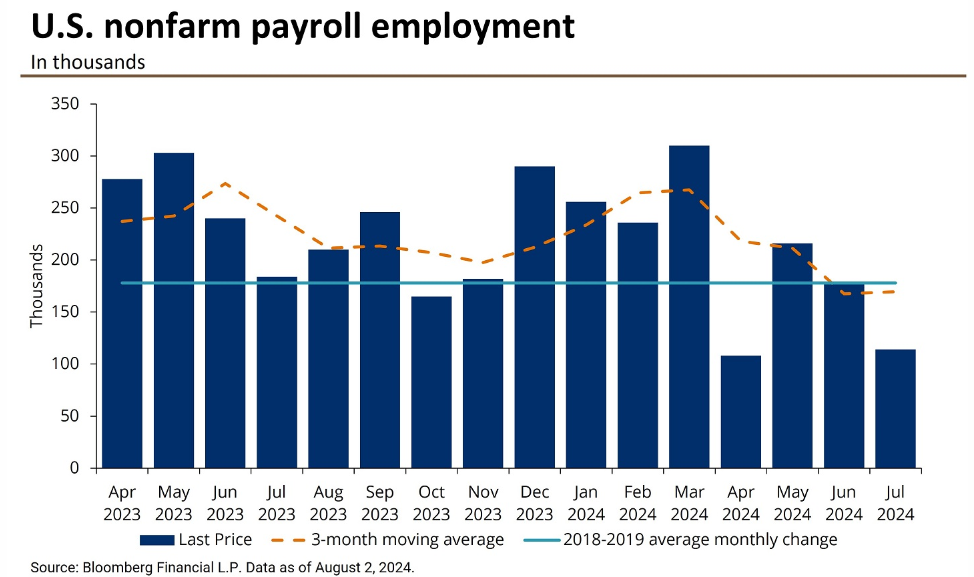

A cooling job market was a key factor in the market downturn on August 5th, as reflected in a jobs report showing a sharper-than-expected decline in US nonfarm payroll employment from June to July. This outcome aligns with the Fed’s current policy, but it remains uncertain whether a “soft landing” will be achieved or if the economy will enter a recession. It is our opinion that a rate cut of at least 0.5% should be implemented to counteract the lagging effects of elevated rates over the past few years.

- Family Tax Planning

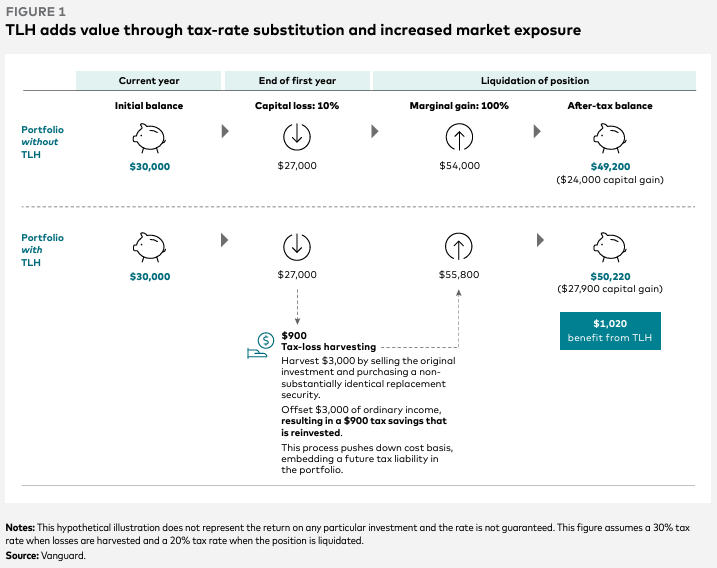

We help turn your losses into opportunities. Many people struggle with the idea of selling an investment at a loss, however, savvy investors can use these losses to reduce taxable income, especially during significant market downturns. Losses can be found in both bull and bear markets if you know where to look. By carefully identifying and harvesting losses at the individual lot and position level, we help lower your taxable income and save on taxes by offsetting gains. This strategy can generate excess net returns over time, especially for those in higher capital gains tax brackets or those anticipating substantial gains from a property or business sale.

The illustration below highlights the benefits of Tax Loss Harvesting (TLH) with an example scenario.

- We continue to practice active tax management.

Many people mistake tax procrastination for tax management, focusing on minimizing taxes this year rather than over their entire lifetime. We prioritize reducing your tax burden over the long term, potentially benefiting not just you but also your heirs. For those with large Traditional IRAs, the focus is often on reducing taxable income each year, but this approach can lead to a much larger tax bill in retirement. High taxable income from large RMDs and IRMAA surcharges can significantly erode years of hard work and savings. We work with you before retirement to develop personalized tax strategies to efficiently reduce your Traditional IRAs and manage your taxes for the long term.

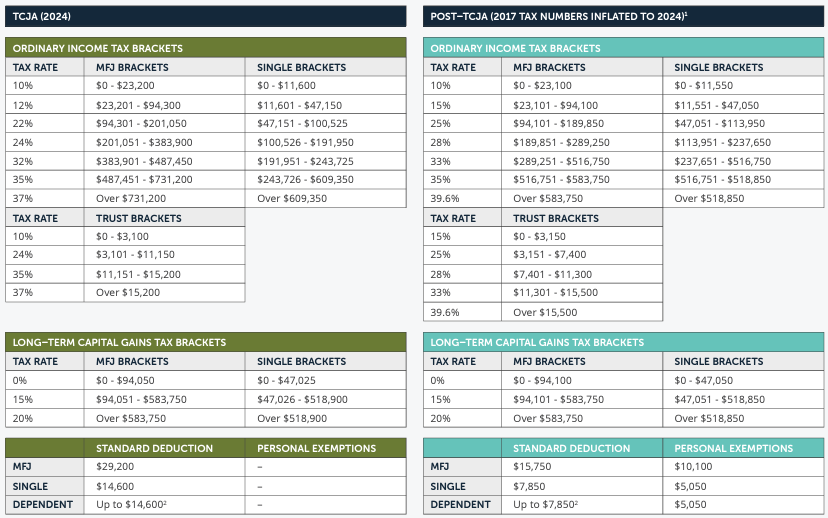

- We are considering the expiration of the Tax Cuts and Jobs Act (TCJA) at the end of 2025.

If you think taxes are high now, the expiration of the TCJA at the end of 2025 might bring an unwelcome surprise. The TCJA significantly lowered individual taxes and doubled the estate tax exemption. Before it expires, we aim to help our clients take advantage of the current lower tax rates. This includes strategies like partial Roth conversions, backdoor Roth IRA contributions, large IRA distributions, QCDs, Donor Advised Funds, and more—all before time runs out.

- We continue to review existing estate plans.

We believe a truly successful estate plan balances both effectiveness and optimal efficiency. An effective estate plan correctly manages and distributes assets according to the individual’s wishes. Precise and law-binding language, in addition to a thorough understanding of the individual’s circumstance, is required to ensure that mistakes are avoided. An efficient estate plan achieves its goals while minimizing costs (e.g. professional fees, taxes, etc.), preserving privacy, and alleviating additional stress on loved ones.

- We assist our clients in determining social security optimization and Medicare Options.

Maximizing your Social Security benefits involves evaluating various factors, including life expectancy, retirement income sources, and personal preferences. After years of contributing to the system, it’s essential to ensure you maximize benefits according to your personal situation.

Medicare can be complex, with many components to consider. Our relationships with Medicare benefits experts allow us to collaborate closely with them to help you find the best plan tailored to your unique needs.

- We help you create a plan.

Too often investors do not have a plan beyond “buy and hold” or purchasing the latest headline stock on Yahoo! Finance. We firmly believe that everyone can benefit greatly from a plan that lays out a route from Point A to Point B and addresses the many life changes along the way. Simply put, a financial plan in place helps you achieve your financial goals.