US equities have been exceeding expectations this year.

The performance of US Large-cap stocks has largely been fantastic in 2024, with the S&P 500 up almost 10% since the start of the year (*as of 5/14/24) which can be attributed to the hopes that a “soft landing” has been achieved by the Federal Reserve and interest rate cuts may ensue, in addition to exciting new innovations in the form of Artificial Intelligence.

Predicting market responses to new information, such as inflation, interest rates, and election outcomes, remains highly improbable. Nevertheless, It’s evident that recent returns have rewarded disciplined investors handsomely, even more so for some “stock pickers” – notably, in such periods as these, investment professionals tend to encounter a heightened appetite for risk-taking from clients.

“Nvidia is up 84% this year, Amazon 23%, Meta 33%… why don’t I own more stocks?”

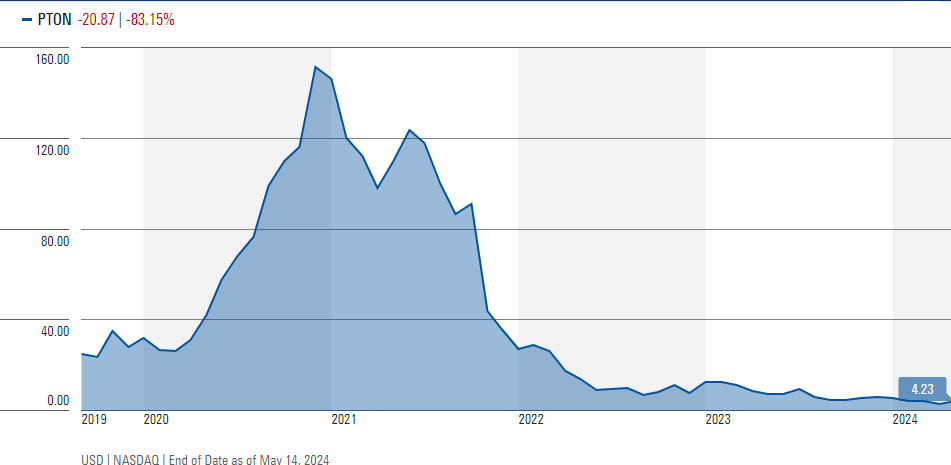

The psychology of “FOMO” (fear of missing out) often describes the emotions investors feel in response to soaring returns. While this is a natural reaction, it can be dangerous to let these emotions guide decision-making. Time and again, we have seen relatively unknown investments gain major attention, only to subject FOMO-driven investors to poor risk-adjusted returns over time. For example, Peloton (NDAQ: PTON) has decreased almost 97% in value since its December 2020 high, along with numerous other securities once touted as “companies of the future” during the pandemic.

Peloton’s performance:

- YTD: -32.84%

- 2Y: -74.24%

- Since Inception (9/23/19): -83.15%

“It’s no surprise for speculative investments to deliver poor results… but what about investing in ‘proven’ companies?”

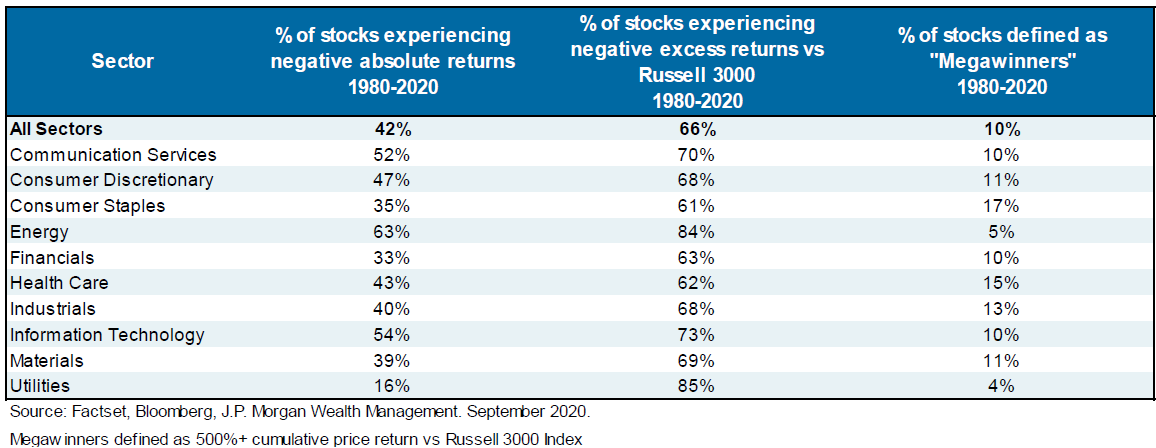

This is a valid point and worth considering, but what does the data tell us about individual stock ownership? The data indicates that selecting equities that will outperform the broader market index in the long term is extremely challenging. A 2021 study found that 40% of all companies ever included in the Russell 3000 index (representing 96% of all US public equities) from 1980 to 2020 experienced a catastrophic loss, defined as “a 70% decline in price from peak levels which is not recovered.”

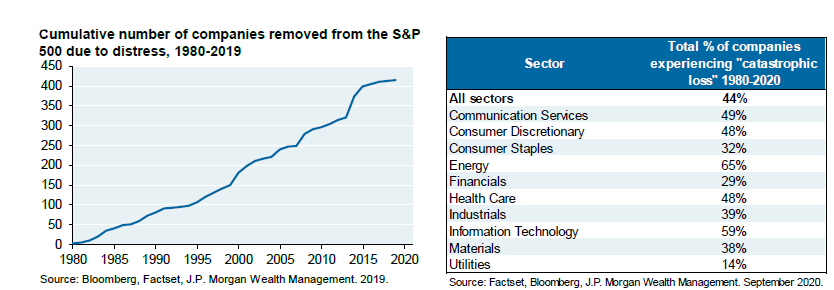

As shown in the graph and table below, over 400 companies have been removed from the S&P 500 over the past 40 years. This is not surprising, given that innovations over the years have caused significant shake-ups in various industries, resulting in new companies rising to the top while others decline.

Delving deeper into the pros and cons of concentrated positions in individual securities, the chart below illustrates that, on average, about 70% of companies in each major sector delivered negative excess returns compared to the Russell 3000 Index. In other words, these companies’ investment returns were lower than that of the broad-market index.

How can concentrated positions be diversified?

Investors looking to reduce their exposure to a single security have several options, which should be evaluated individually, considering factors like tax liabilities and estate planning needs.

Selling your position:

To manage your investments, you can sell all or part of your shares, prioritizing those with a higher purchase price to reduce taxes if your account is taxable, and keep in mind that shares held for less than a year are taxed at a higher rate.

Gifting to family or charity:

Gifting shares to a family member can be beneficial but because you transferred your cost basis the receiving party may pay capital gains taxes if shares are sold, so consider their current and future tax rates.

Gifting stock to a qualifying 501(c)(3) charity allows you to deduct its market value up to 30% of your Adjusted Gross Income, and using Donor Advised Funds (DAFs) – which qualify as a 501(c)(3) – can provide immediate tax benefits while deferring the actual donation.

A Charitable Remainder Trust (CRT) lets you donate appreciated stock, avoid immediate capital gains taxes, receive annual payments, and leave the remaining balance to charity after your death.

Contribute to an Exchange Fund:

An exchange fund allows investors to trade highly concentrated positions for a stake in a diversified portfolio without immediate capital gains, requiring a minimum 7-year holding period, after which investors can receive a diversified portfolio or pass the account to heirs with a step-up in basis.

These funds typically have eligibility requirements for both the value and identity of the security, as well as the financial qualifications of the investor, e.g. accredited investor requirements.

Hedge your position:

This strategy is complex as it involves buying put options to protect against significant stock value declines, with associated premiums and costs.

In conclusion, the purpose of this newsletter is not to condemn individual stock ownership but to explain the rationale behind avoiding concentrated positions as part of our investment philosophy. In some cases, individuals may hold stock options or existing stock positions with a low-cost basis in taxable accounts, making it difficult to sell without incurring significant tax consequences. As fiduciary-only financial planners, we are committed to considering an individual’s entire financial picture—both current and future—and adjusting their total asset allocation to align with their objectives.

That being said, we recognize that clients may have a strong desire to own individual stocks or manage a portion of their assets independently. In such cases, we encourage opening self-directed accounts depending on each individual’s unique situation.

On this Memorial Day, we come together to honor and express our deepest gratitude to all who have served our great country, both past and present. We remember the brave men and women who have made the ultimate sacrifice to protect our freedoms and way of life. As we reflect on their service, let us also extend our heartfelt thanks to the families of our service members, whose support and sacrifices are equally profound. Today, we salute our heroes and commit to preserving the values they fought to defend.