By Eileen Ortega, CTFA

As I suspect most would agree, the past few years have felt like a roller coaster ride, from a pandemic to global and domestic crises of many kinds. Our discomfort from these events has been coupled with erratic financial markets, giving many pause when considering investing their savings or considering retirement.

According to a survey conducted earlier this year, “25% of Americans are delaying retirement due to inflation.” https://www.cnbc.com/2022/05/31/25percent-of-americans-are-delaying-retirement-due-to-inflation.html

Not surprisingly, “Younger Americans have been the most adversely affected. More than 60% of those ages 18 to 34 said they had to pull back savings contributions to make up for rising costs of necessities.

In addition to grappling with higher prices on nearly all goods and services, Americans are facing a volatile stock market that may have also contributed to shifting retirement timelines.”

What is the Purpose of a War Chest?

Many of us may recall the advice received from our parents when we were first starting out on our own:

- Live within your means

- “Pay yourself First” by investing in an Employer Retirement Plan

- “Don’t risk what you can’t afford to lose”

- Always keep approximately 6 months worth of expenses in savings to protect from loss of income or to cover unforeseen expenses

While these likely seemed uncomplicated at the time, once life gets in the way, it’s easy to lose sight of these things, or to rationalize why you “simply can’t” and it will “have to wait”.

Fast forward 25-30 years, and this advice has stood the test of time.

- Spending within your means has likely led to a comfortable lifestyle

- Employer Retirement plans continue to be the “easiest” way to pay yourself first

- Understanding Risk in investing is paramount to a positive investor experience

Which leads to the last item-keeping a “safety bucket” to cover expenses. The advice we provide to clients when determining how much to put into the market, and how much risk is acceptable for these funds begins with understanding how much should first be allocated to their “War Chest”. Think of a War Chest as the modern version of keeping money under the mattress. It is the amount that you choose to keep in a “Safe Bucket” and is often viewed as a number of months or even years of expenses that will allow you to comfortably deploy savings above this into the markets.

The worst-case scenario for any investor is having to pull funds from the portfolio when the market is in a deep decline. To avoid this, separating out your “War Chest” with sufficient funds to carry you through a depressed market will not only ensure your investments recover when the market turns, but it will give you significant peace of mind knowing that while your investments might be down, you will not have to realize any of these losses because your living expenses will be covered by the “safe money”. As the market recovers, the “war chest” can then be replenished, leaving the long-term success of your plan intact.

What is the Right Amount to Allocate to the War Chest?

The key to knowing how much the War Chest needs is a solid understanding of your expenses. Once you know how much it costs to “run your life” on a monthly or annual basis, you can begin to calculate the appropriate amount to set aside. Following are critical factors to consider when coming up with this amount:

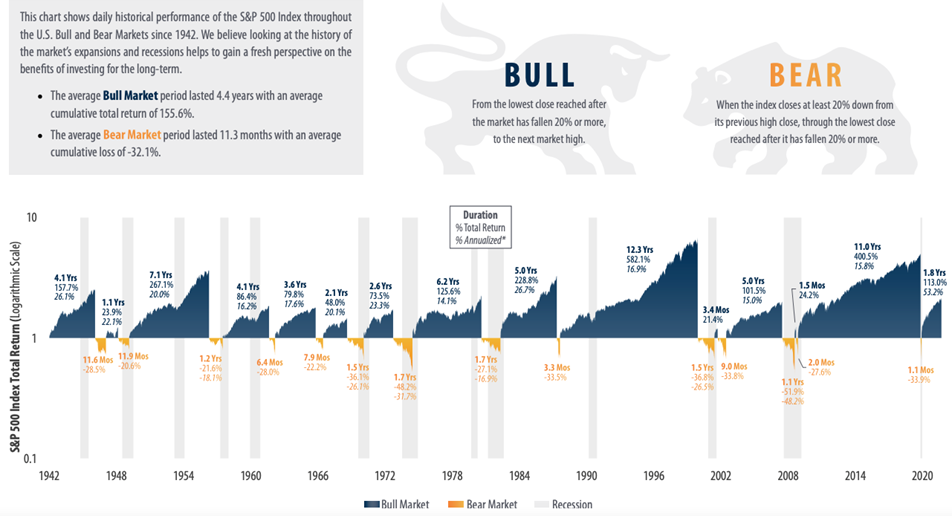

- The average Bear Market (during which you want to avoid liquidating assets to cover expenses) lasts approximately 1 year (see chart below)

- If you are actively withdrawing from your portfolio, the War Chest should cover at least this period. If you have enough outside income that you are not withdrawing from your portfolio, the amount of safe funds can be less, but it is critical to turn to your “feelings” to determine the amount that will reduce your worries during any downturn.

- And the most important factor-there is NO RULE to this-everyone is different and it is critical for you to decide on what is appropriate for YOUR peace of mind.

Source: First Trust Advisors L.P., Bloomberg. Returns from 1942 – 2021.

These results are based on daily returns–returns using different periods would produce different results

It’s easy to get pulled into the 24 hour news cycles which, in addition to “reporting the news”, sometimes employ fear mongering to keep you glued to their programming. Every hour there is an update on markets, good or bad, there are countless “experts” talking about the latest hot investment tip, and the drama can give soap operas a run for their money! But if we take a step back, and truly get back to the basic tenets of financial prudence that our parents ingrained in us, we can create a plan that not only anticipates the ups and downs, but that keeps us grounded throughout, knowing we have set aside an “emergency fund” to see us through any market.

Leaning on a Trusted Financial Advisor to determine the best allocation for your situation will allow you truly focus on what’s important, whether that’s a career, a family, or a retirement.