In ‘normal’ times, the best advice following a market decline is “Keep calm and carry on.” With all that is going on in the world right now, however, we might be thinking that this time is different, and as a result, fear begins to drive our decision making. The trick is to look at market reactions from a historical perspective and to channel your fears into sensible actions that will improve your financial future.

What does history tell us about what to do?

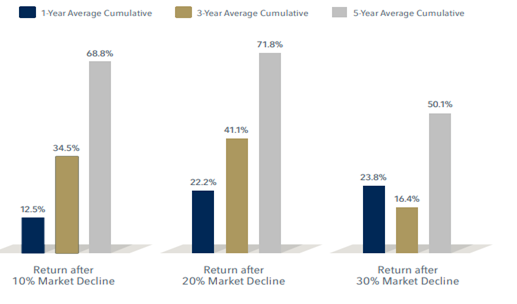

Sudden market downturns can be unsettling, and it might seem like there is no end in sight. But historically, US equity returns following sharp downturns have, on average, been positive. The chart below shows that since 1926 US stocks have tended to deliver positive returns over one-year, three-year and five- year periods following steep declines.

Fama/French Total US Market Research Index Returns

July 1, 1926 – December 31, 2021

Source: Dimensional Fund Advisors LP.

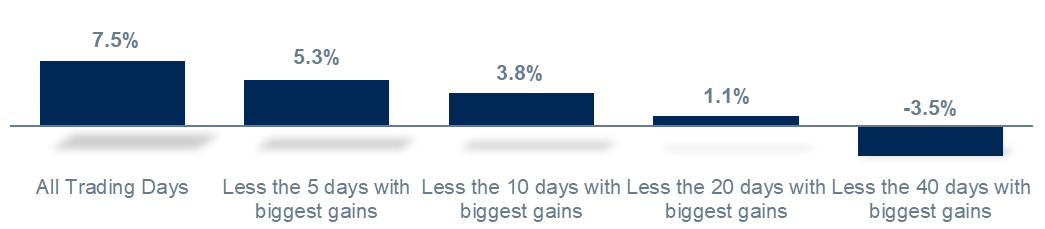

The data is not saying that we cannot go lower, we certainly can. But history tells us that sticking with your plan helps put you in the best position to capture the recovery. In fact, since a large proportion of the long-term gain in the stock market comes from sharp upward bursts, missing just a few of the best days results in dramatically lower returns than staying invested.

Annualized S&P 500 Returns Including Dividends

January 1, 2000 – December 31, 2021

Source: Morningstar Direct. Data as of 12/31/2021

Improving Your Financial Future

If staying invested works best during a big drop in the market, what should you do if you feel like you are losing out by staying the course? Take time to distinguish what you can control from what you can’t. Instead of trying to predict what will happen in the market over the short term, take charge of the risks you run, the taxes you incur, and what you spend. Taking these steps can help to restore some control over a painful situation and can make the pain more bearable.

Ask yourself if you are taking the right level of risk

How much risk you take in your investments plays a big role in ensuring your long-term success. Your risk level should be determined by your financial assets, short- and long-term goals, income needs, and tolerance for volatility. Each of these change throughout your life and should reviewed on a regular basis. It is important to look at both your “risk need” and “risk want.” Judge how much risk you want to take during both up and down markets since this can change based on your current perceptions. You might find that your current views are driving your desire to change your portfolio, not an actual change in your circumstances. If you do determine that you are taking too much or too little risk, make a plan to change your asset allocation. These changes should be gradual and incremental, rather than sudden and drastic, especially after a big drop in the market.

Separating your assets into different risk buckets can help with the pain of a drop in your overall portfolio. Designate the cash and short-term part of your portfolio as your “war chest.” Filling this bucket with sufficient funds to carry you through a depressed market will give you significant peace of mind knowing that though your investments might be down, you will not have to realize any of these losses because your living expenses will be covered by the “safe money.” With the Federal Reserve raising interest rates, Treasury bills, money market funds, I Bonds and high yield savings accounts are some great ways to provide peace of mind.

Take an opportunity to reduce your tax bill

Opening your latest statement and seeing your investments worth less than you paid for them is painful, but there is a silver lining. You can sell your depressed investments at a loss, typically for the difference between a holding’s purchase price and its sale price. You can then use these losses to offset taxable capital gains from a broad range of assets, either right away or in the future. If you do not have enough taxable capital gains, then you can deduct up to $3,000 of losses per year against ordinary income such as wages or interest.

You should also use this as an opportunity to drop overpriced funds with underperforming managers. Now you can ditch them and replace them with lower-cost options without a big tax bill.

How much difference can loss harvesting make to your total returns? A Vanguard study found that while returns for individuals vary greatly depending on circumstances, many investors can add between 0.5% and 1.5% a year to total returns by harvesting losses.

Understand what you are spending

During a big market drop, it is a good idea to take a hard look at what you are spending and to prioritize what can stay and go. Funding your lifestyle by selling assets that have fallen in price is painful and having the ability to continue to invest at lower market valuations can significantly improve your long-term success. For people still in their prime earning years, a decline is likely to be as beneficial in the long run as it is painful in the short run, as long as they maintain a plan to invest on a regular basis when asset prices drop. Given that just about everything else is more expensive right now, this might mean cutting back where you can in other places, but your future self is sure to thank you. For older investors without another source of income outside their portfolio, the decline can be potentially devastating and knowing where you can cut back is much more important.

If you have not already, begin to work on organizing your expenses and creating a budget. To start, calculate your average monthly expenses and know how much money is coming in versus going out. Next, review your ongoing monthly bills to identify those items that can be “paused” or eliminated altogether. Lastly, categorize expenses into “essential” and “discretionary”. It helps to express your discretionary spending as a range. That way, you can choose to put aside unspent money in months when your costs are at the bottom end of the range and use it during months when your discretionary spending may be higher.

Market history has taught us that declines are inevitable and are caused by a myriad of global events. One is not like another in its intensity, duration, or cause; however, a common thread is that there will be a recovery. The bottom line is that we should expect it and to take steps to control what we can. This will not eliminate our fear but just might help us to manage it.