Employees in both the private and public sectors have various options for saving for retirement. The most common retirement plans are 401(k)s, 403(b)s, and 457 plans, but others like SEP-IRAs and SIMPLE plans are also widely used. While most people know about the pre-tax savings these plans offer, there are other tax strategies available that are often overlooked.

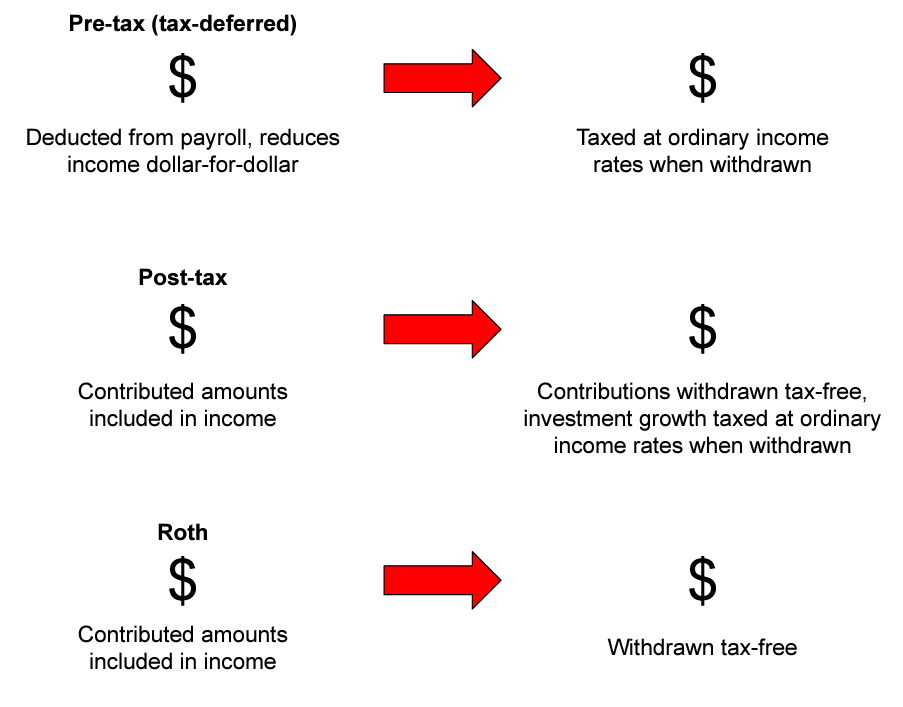

Before discussing savings strategies for defined contribution plans (such as the plan types mentioned above), let’s cover the basics. Keep in mind that these plans can vary between businesses and organizations, so not all defined contribution plans are exactly the same.

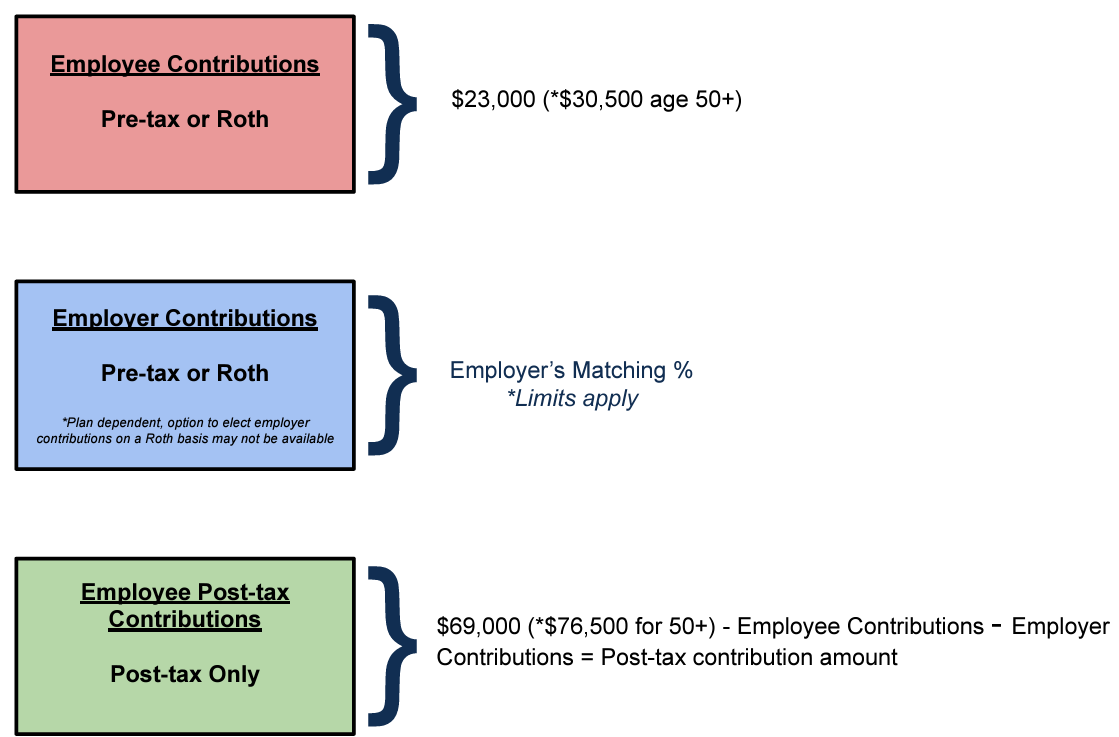

Super-savers can use post-tax contributions to boost their retirement savings beyond the annual limit of $23,000 (or $30,500 if you’re 50 or older) in 2024. These contributions are a hybrid between pre-tax and Roth contributions: the money you contribute grows tax-free similar to Roth contributions, but any investment growth on these contributions is taxed as income when withdrawn.

How are Post-tax contributions used to maximize the total annual contribution limits?

As seen below, employees are subject to an annual limit of $69,000 (*$76,500 for 50+) contributed to their defined contribution plan in any single year. After taking into account the sum of employee and employer matching contributions, any remaining amounts can be made on a post-tax basis to maximize the annual limit.

*Plan dependent, Roth contributions to employer-sponsored retirement plans may not be available.

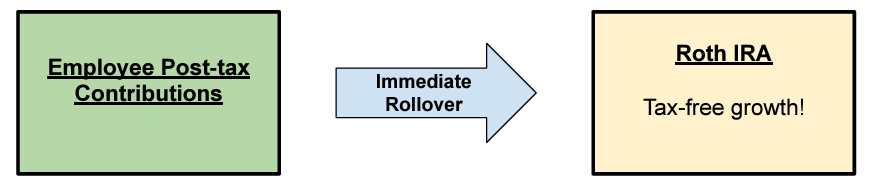

The biggest advantage of post-tax contributions: The Mega Backdoor Roth

A drawback of post-tax contributions is the extra work needed to track investment growth. However, you can avoid this by quickly rolling post-tax contributions into a Roth IRA before they earn any growth. This is a legal maneuver in the eyes of the IRS because post-tax contributions are already included in your taxable income, allowing them to be moved to a Roth IRA without any complications.

*Individual plan must allow for in-service rollovers – check with your HR representative to determine if this strategy is available to you.

This is one strategy to consider for those aiming to maximize their retirement savings. It should be evaluated on a case-by-case basis, taking into account the individual’s specific goals and objectives.