The Tax Cuts and Jobs Act enacted under the Trump administration in 2017 brought with it major changes in the way of tax and other regulatory implications. As of now, TCJA is set to sunset in December of 2025, which means many policies will revert to their original guidelines pre-TCJA.

We have summarized the most pertinent changes that are applicable to our clients and discuss how all financial plans are created and monitored with the potential changes to our tax codes and other regulatory statutes in mind. It is our job to stay up to date on the details of the ever-evolving regulatory environment, and to inform on the strategies we are employing to navigate these changes with clients' best interests in mind.

Notable Changes

Individual tax provisions

- Standard Deduction

- The TCJA nearly doubled the Standard Deduction for taxpayers, which led many to opt for this deduction over Itemized Deductions for tax savings. As of now, the Standard Deduction will likely revert to the pre-TCJA amount of $6,350, adjusted for inflation accordingly to 2026.

- Home Equity & Mortgage Interest

- Under The TCJA, the home mortgage interest deduction was capped at $750,000 of debt for loans starting on or after Dec. 16, 2017. From 2026 onwards, the mortgage interest deduction will return to pre-TCJA levels, permitting deductions on the first $1 million in home mortgage debt and $100,000 in a home equity loan.

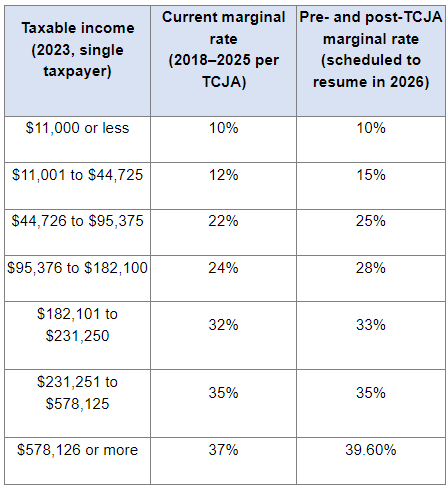

- Tax Rates Reversion

- Tax rates are another important change under TCJA, with higher earners facing higher rates post-TCJA.

- Charitable giving deductions

- The ceiling for charitable contribution deductions was raised to 60% of a taxpayer's Adjusted Gross Income (AGI) for cash donations, from the pre-TCJA deduction of 50% (set to return in 2026).

- Miscellaneous Itemized Deductions

- Most miscellaneous itemized deductions were eliminated under TCJA (investment/advisory/legal fees, unreimbursed employee expenses, etc.). These deductions are set to be allowed in 2026, if the amount(s) exceed 2% of a taxpayer's AGI.

- Alternative Minimum Tax exemption & phaseout

- The Alternative Minimum Tax (AMT) is a separate tax system created for high-income taxpayers. If a taxpayer has a high enough income, they will be subject to paying their AMT liability in lieu of their ordinary income tax liability if the former is of greater value. The TCJA increased various thresholds and exemption amounts for taxpayers, substantially lowering the amount of US citizens exposed to the AMT. It is estimated that roughly 5,000,000 taxpayers were subject to paying AMT in 2017 (pre-TCJA), and only about 200,000 taxpayers were required to pay AMT in 2018 (Source: Tax Policy Center).

- Child tax credit

- The child tax credit was increased from $1,000 to $2,000 per qualifying child. This higher tax credit will revert to pre-TCJA levels in 2026 of $1,000 per qualifying child.

Business tax provisions

- Qualified Business Income (QBI) 20% deduction

- Individuals who own passthrough businesses like partnerships, S corporations, and LLCs are currently eligible to receive a deduction of up to 20% of their Qualified Business Income (QBI). However, starting in 2026, the deduction under Section 199A for QBI will no longer be accessible.

Estate and gift taxation

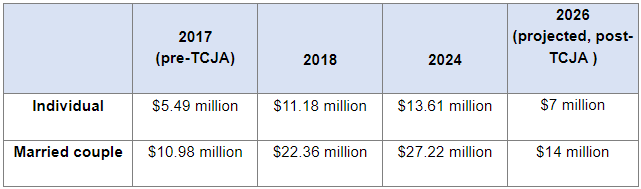

- Lifetime Estate & gift tax exemption reduction

- One of the most important changes under The TCJA sunset is the lifetime estate and gift tax exemption shrinking to nearly half of TCJA levels. We saw an increase in this exemption from $5,490,000 to $11,180,000 in 2017, which has resulted in significant tax savings for those looking to transfer wealth to their heirs. Taxpayers who pass away after the TCJA expiration may be subject to a federal tax rate of up to 40% for estate balances in excess of the exemption amount if proper estate/legacy planning is not set in place.

Source: Congressional Research Service

What does this mean for you?

The purpose of this newsletter is to convey the importance of tax planning and estate/legacy planning at our firm. The reason why we constantly nudge our client's for financial documents, especially recent Tax Returns, is so that we can utilize powerful tax planning software to analyze their situation and determine which strategy results in maximizing wealth and achieving their financial goals. Due to the changes set to occur in 2026, we will especially be prioritizing tax planning analysis, which does not simply focus on how to lower one's tax bill in the current year but which also prioritizes decreasing one's total lifetime tax liability and their heir(s) in accordance with their succession wishes.

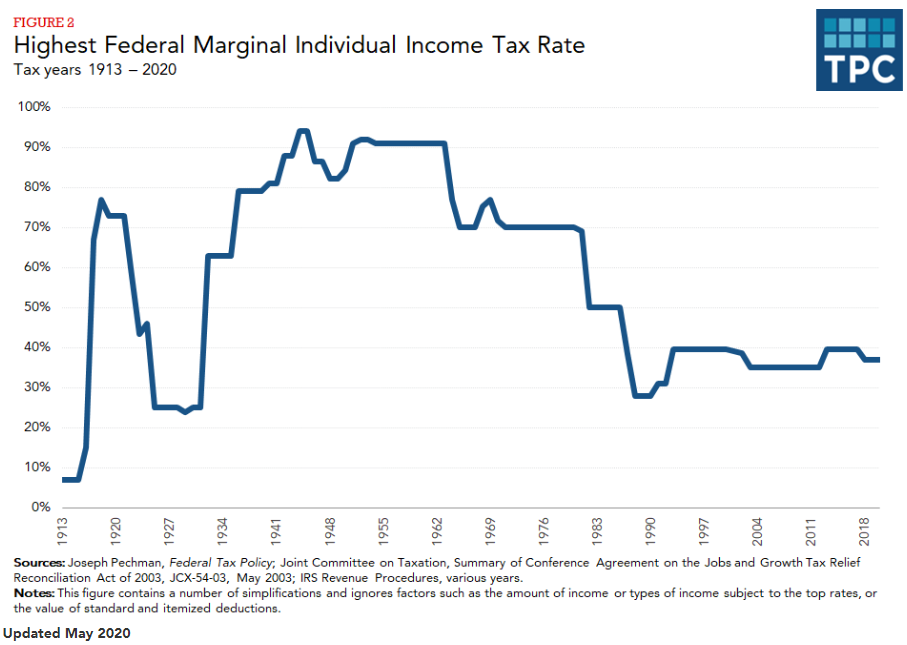

According to the line chart above, marginal income tax rates are currently situated at historically low levels. This circumstance significantly amplifies the impact of specific tax planning methodologies on an individual's cumulative tax obligation over their lifetime, notably exemplified by strategies like Roth conversions, Spousal Lifetime Access Trusts (SLATs), and more. Although it is improbable that most Baby Boomers and Generation X taxpayers will experience reductions in Social Security benefits during their lifetimes, it is essential to acknowledge the ongoing strain on this public benefits system. The potential necessity for additional funding, possibly in the form of increased tax revenues, to sustain these benefits (and other public benefits systems) prompts us to consider a potential rise in tax rates in the foreseeable future.

Subject to any significant announcements from the current administration, our approach involves a prudent strategy that anticipates a return to pre-Tax Cuts and Jobs Act (TCJA) guidelines for many policies. Our overarching mission is to optimize long-term wealth while aiding clients in attaining their financial objectives. Achieving this mission necessitates a comprehensive understanding of the dynamic regulatory landscape. We eagerly anticipate the opportunity to assess and determine the most suitable options tailored to each client's unique circumstances.