We often have clients who hesitate to invest when they believe the market is near a peak, worried that a downturn could cause immediate losses. One way to address that concern is through dollar cost averaging (DCA), the practice of investing a fixed amount on a set schedule regardless of market conditions. It’s the default approach in most workplace retirement plans, where a portion of each paycheck is automatically invested. When prices are low, your fixed contribution buys more shares. When prices are high, it buys fewer. The goal isn’t to time the market but to build discipline and maintain consistent participation.

This concept can also apply when you have a large sum to invest. Imagine you receive a $120,000 windfall instead of making regular monthly contributions. With a lump sum approach, you invest the entire amount right away in your target portfolio. With DCA, you might spread the investment out by putting in $10,000 each month over a year, gradually entering the market rather than all at once.

If the market drops shortly after you start, DCA allows you to buy more shares at lower prices during those later months. But if the market rises soon after your first investment, lump sum investing (LSI) will usually come out ahead because more of your money has been in the market longer. Since markets tend to rise over time, this advantage of being invested earlier, often called the “time in the market” effect, plays a big role in long-term results.

What Historical Research Finds

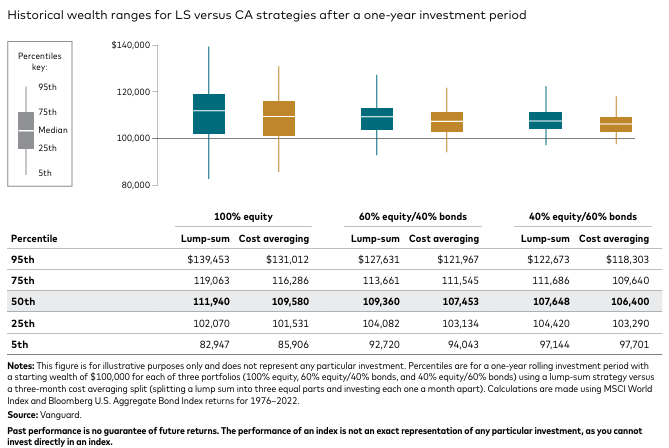

Vanguard conducted a comprehensive study comparing dollar cost averaging with lump sum investing across three major markets: the United States, the United Kingdom, and Australia.

They analyzed historical returns using a wide range of portfolio combinations, including all-equity portfolios, balanced portfolios with varying mixes of stocks and bonds, and conservative portfolios more heavily weighted toward fixed income. Each strategy was tested across thousands of rolling time periods to ensure the results were not skewed by a single market environment.

They found that lump sum investing outperformed DCA approximately two-thirds of the time across all three countries and all portfolio types. The main reason is simple math: markets tend to rise over time. Since lump sum investing puts the full amount of money to work immediately, it gives the investor more exposure to long-term market growth. This allows compounding to begin earlier and often results in higher total returns, especially when markets are trending upward.

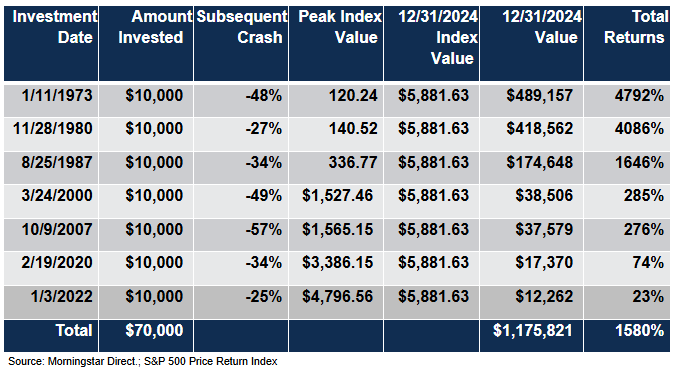

We also looked at what happens when you invest a lump sum at some of the worst possible times. While your returns would be lower than if you had invested steadily over time, even buying at market peaks has not derailed long-term success, as long as you stay invested. The table below shows an investor who put $10,000 into the S&P 500 at each peak before major market downturns since 1973 and then did nothing else. By 12/31/2024, this “unlucky” buy-and-hold investor still had more than $1,175,000, not including reinvested dividends.

The Behavioral Factor

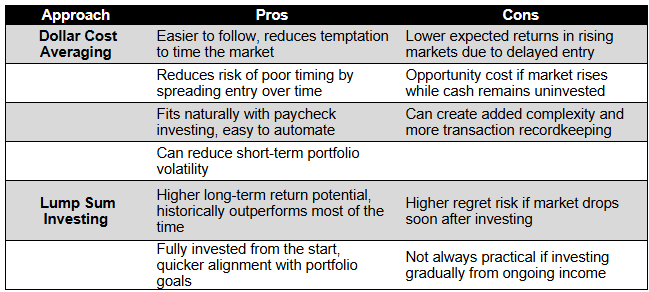

Investment choices aren’t made in a lab; they are made by humans who dislike losses about twice as much as they like gains. Prospect theory, the backbone of behavioral finance, documents this loss aversion and the way people frame outcomes. That aversion makes the fear of investing right before a drop feel much worse than the joy of catching a rally, which is why the staged approach can feel safer even if it often sacrifices return. DCA helps by reducing the chance of immediate regret and by turning market volatility into a mechanical buying plan, which many investors find easier to stick with.

A Practical Decision Framework

If you have a windfall and a strong stomach, history favors investing it promptly according to your preferred asset allocation. To manage the psychological risk, consider splitting the difference. Invest a large initial chunk today, for example, 60 percent, and spread the remainder over three to six months. This keeps most of the time in the market benefit while preserving some regret insurance. The right split is personal, but the logic is consistent with the research; earlier investment has a higher expected payoff.

If you are anxious about timing, choose a DCA schedule you can finish. Set specific dates and amounts, automate them, and resist the urge to pause after a bad headline. The aim is to remove discretion, since ad hoc delays can turn DCA into market timing in disguise.

Most importantly. Match your portfolio to your goals and risk capacity, use low-cost diversified funds, and keep cash only for near-term needs or emergency reserves. Rebalance periodically and manage taxes with asset location and tax loss harvesting where appropriate. These choices usually matter more than the entry tactic you pick for one deposit.

Bottom line

Lump sum investing has a clear historical edge because markets tend to rise over time, which rewards earlier participation. Dollar cost averaging remains a powerful tool because it makes good behavior easier and reduces the chance that fear or regret will knock you off plan. If you can invest a lump sum and stay the course, the odds favor doing so. If you know that a staged, rules-based plan is what will keep you invested, DCA is the right tool for you. The best strategy is the one you can follow through the next downturn and the one after that.