One of the most frequently discussed topics among those nearing or in retirement is how to create an effective withdrawal strategy.

A common approach to retirement withdrawals is to tap into the most liquid assets first—typically cash reserves and taxable investment accounts—before drawing from tax-deferred retirement accounts such as Traditional IRAs and pre-tax 401(k)s. While this sequence is often widely recommended, it doesn’t always lead to the most efficient outcome. In fact, relying solely on this traditional order can overlook opportunities to reduce long-term tax liability, manage Medicare premium thresholds, and preserve the longevity of retirement savings. A more tailored strategy that incorporates a mix of account types, thoughtful tax planning, and timing considerations often results in a more favorable financial outcome over the course of retirement.

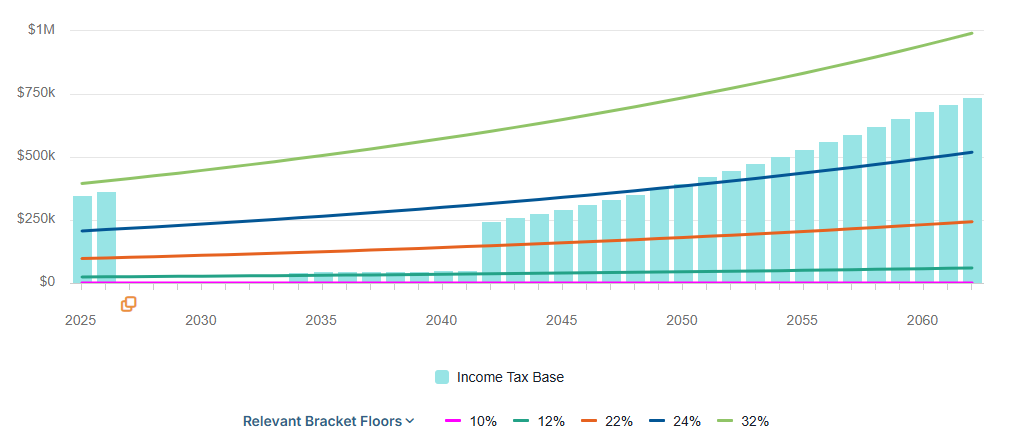

For illustrative purposes, the chart below outlines a typical income tax trajectory for individuals who have accumulated assets in both tax-deferred retirement accounts and taxable investment accounts over time. In this scenario, the couple is two years from retirement and has been disciplined savers, holding approximately $1.5 million in combined pre-tax retirement accounts, $300,000 in money market funds, and $1 million in taxable investments. They plan to withdraw approximately 4% of their total portfolio annually until Social Security benefits begin, when their withdrawals will taper down.

Based on our experience working with individuals from all walks of life, the early years of retirement are often supported by spending down available cash reserves in checking/savings/money market accounts. Any additional expenses may be supported with modest withdrawals from taxable investments and/or tax-deferred retirement accounts. By the time Social Security benefits begin, many retirees have settled into their new lifestyle and typically need only limited additional withdrawals from their investment portfolios to meet ongoing income needs. Our “example couple” will employ this strategy when entering retirement.

The result?

Later in retirement, Required Minimum Distributions (RMDs) can become substantial, often compounding and pushing individuals into significantly higher marginal income tax brackets. The chart below illustrates the potential tax impact for an average couple approaching their 60s, with RMDs beginning at age 75. In the example below, we see a slight uptick in income when Social Security is filed at Full Retirement Age (2034), and a major jump in tax liability when RMDs kick off in 2042 and continue until the end of life – age 95 is the assumed life expectancy in this example.

Scenario 1: Spend down taxable accounts now, defer withdrawals from retirement accounts.

***The blue bars show the income tax base – or the combined income in a given year as measured by the dollar scale on the vertical axis.

What is a viable solution?

The true answer is that “it depends.” Each financial situation is unique, shaped by individual goals, timelines, and circumstances. While there’s no one-size-fits-all solution, a wide range of strategies should be considered when planning for retirement. What remains consistent is that developing a thoughtful plan early on is almost always more effective than waiting until later in life.

Potential strategies include making Roth contributions to employer-sponsored retirement plans, such as Roth 401(k)s, to help diversify savings across different tax “buckets” and increase withdrawal flexibility in retirement. Another approach involves converting strategic portions of pre-tax retirement accounts during retirement, which should be evaluated annually to weigh the costs, benefits, and overall viability. Finally—and the primary focus of today’s discussion—is the use of a coordinated withdrawal strategy from multiple account types to help smooth out the tax burden over time.

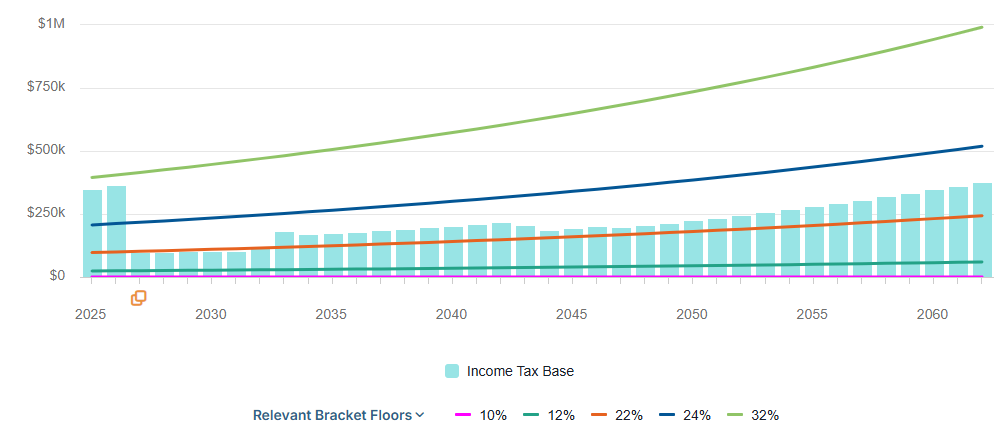

As illustrated in the chart below, the same example is revisited—this time using a coordinated withdrawal strategy that draws on cash reserves for short-term needs while maintaining a war chest of safe assets. Regular monthly distributions from both pre-tax retirement accounts and taxable investments are used to meet ongoing expenses. This approach helps smooth taxable income over time, resulting in a more gradual rise in income from RMDs and avoiding the jump into the 24% marginal tax bracket (indicated by the blue line), as seen in the initial scenario.

Scenario 2: Cash used for short-term needs, Retirement & Investment accounts for ongoing expenses

***The blue bars show the income tax base – or the combined income in a given year as measured by the dollar scale on the vertical axis.

In conclusion, designing an effective retirement withdrawal strategy involves careful consideration of multiple factors. Age, asset composition, income sources, and legacy objectives all play a critical role in shaping the most appropriate approach. As mentioned previously, there is no universal formula—each plan must be tailored to reflect the specific goals and circumstances of the individual or household. Thoughtful coordination of withdrawals not only supports long-term financial stability but can also help minimize taxes and preserve wealth for future generations.

We value the opportunity to understand each unique situation and collaborate in building a strategy that aligns with both near-term needs and the long-term aspirations of our clients.