A whirlwind of new tax code has been introduced following the passage of the One Big Beautiful Bill Act on July 4th, 2025. We previously shared an overview of the key provisions expected to pass, but now that the legislation has been signed into law, we’ve begun to fully digest the finalized rules and evaluate how they may impact financial planning strategies for our clients moving forward. In this issue, we highlight some of the most relevant updates and outline early considerations that may be worth exploring as part of a broader, long-term planning approach. For a closer look at the key parts of the OBBBA and what they mean, check out our handout here.

⬆️ Increased SALT Deductions

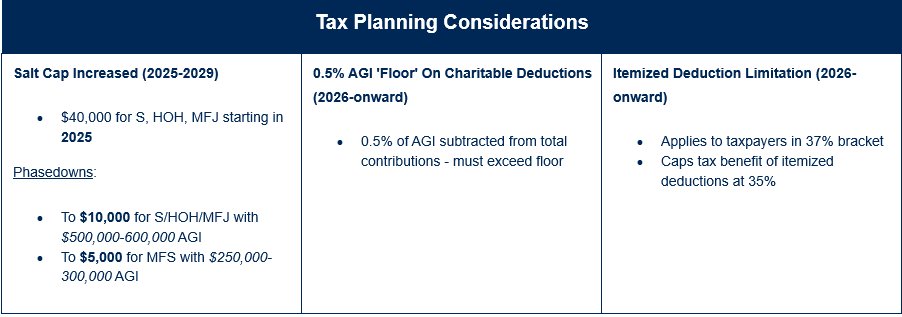

For those who itemize deductions—especially via State and Local Taxes (SALT)—the new $40,000 SALT deduction cap offers a valuable opportunity. Taxpayers near the applicable income limits may benefit from lowering their adjusted gross income (AGI) to take full advantage of the increased deduction. Strategies may include maximizing contributions to pre-tax retirement accounts, Health Savings Accounts (HSAs), or non-qualified deferred compensation plans.

Those with lower SALT exposure who may not fully use the $40,000 cap could consider bunching deductions into alternating years—for example, paying two years’ worth of property taxes within a single tax year—to maximize the benefit.

⏏️ Charitable Deductions ‘Floor’

For those who give to charity, it’s important to note that beginning in 2026, the first 0.5% of AGI will no longer be deductible. In other words, only charitable contributions above that threshold will qualify for a deduction.

While charitable giving is generally driven by values rather than tax benefits, those who regularly contribute—especially through Donor Advised Funds or annual gifts to 501(c)(3) organizations—may want to consider accelerating donations into 2025. Doing so could allow more to go toward meaningful causes and less toward taxes before the new limitation takes effect.

⛔ Itemized Deduction Limitation

This tax code change takes effect in 2026, which introduces a new 35% cap on itemized deductions.

Consider the following example for a taxpayer:

(AGI): $1,000,000

Total itemized deductions before the cap:

- State and local taxes (SALT): $20,000 (capped)

- Mortgage interest: $25,000

- Charitable contributions: $150,000

- Other deductible items: $10,000

- Total itemized deductions: $205,000

- 35% of AGI = 35% × $1,000,000 = $350,000

- Total itemized deductions ($205,000) are below the cap → ✅ no limitation applies

But suppose the taxpayer gave $400,000 to charity that year, and the new total deductions are now:

- Total deductions = $455,000

- 35% of AGI = $350,000

- → Deductions are limited to $350,000 ❌

- The taxpayer loses $105,000 of deduction value due to the cap.

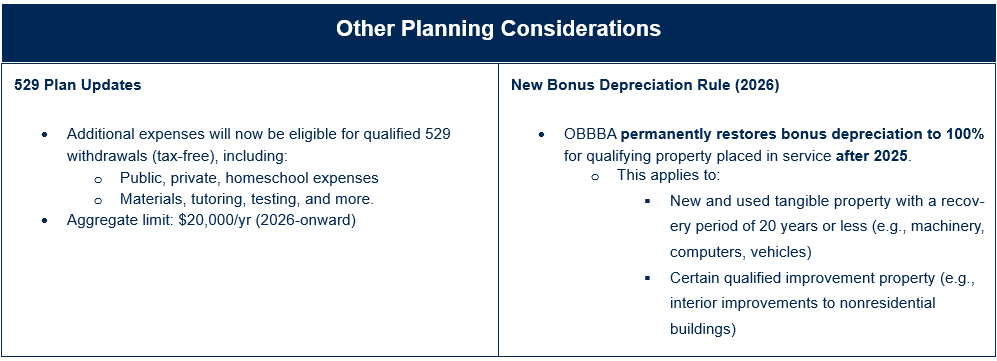

529 Updates

- OBBBA broadens the definition of qualified education expenses to include more non-traditional options. Consider using 529 Funds to Pay for Career Training and Apprenticeships.

- With more flexible distribution rules, front-loading a 529 plan (funding early in a child’s life) becomes more appealing. This allows for more tax-free compound growth while still maintaining flexibility for alternative education paths.

Bonus Depreciation

Under prior law, bonus depreciation (which allows businesses to immediately deduct a large portion of the cost of qualifying property) was phasing out:

- 100% through 2022

- Then stepping down each year: 80% in 2023, 60% in 2024, 40% in 2025, and 20% in 2026

Business owners may consider:

- Delaying large equipment or property purchases until January 1, 2026 or later

- Plan purchases in high-income years to offset taxable income more effectively.

Review Entity Structure to ensure that owners can benefit from the deductions, especially if there are basis limitations or passive activity loss restrictions.

We’re keeping a close eye on all the new tax law changes from the One Big Beautiful Bill Act (OBBBA) to see how they might affect our clients. As we learn more, we’ll keep you updated with advice tailored to your situation.