Estate planning stands as a fundamental pillar within a comprehensive financial plan, having significant influence both prior to and following one’s passing. Given the nuanced nature of each individual’s circumstances, the engagement of a professional team of estate attorneys and financial planners is invaluable for discerning optimal strategies to pursue and formalize within legal frameworks. Estate planning is now more crucial than ever, particularly with the aging of the Baby Boomer and Generation X cohorts who are either approaching or already in retirement. It’s imperative for individuals to carefully consider how they aim to enjoy a fulfilling life during these well-earned years while also ensuring a plan is in place for the future.

This newsletter will explore the significance of estate planning, highlighting several commonly employed strategies, and illustrating how this subject enhances an individual’s comprehensive financial plan.

The Basics of Estate Planning:

Fundamentally, estate planning encompasses the establishment of various arrangements to manage and distribute an individual’s estate both during and after life, consistent with the wishes of the Grantor. While this serves as the basic definition of an estate plan, we contend that a truly successful estate plan achieves two crucial objectives: effectiveness and efficiency across all aspects. Despite the relative simplicity of these criteria, a significant number of plans fall short of meeting these standards.

- An effective estate plan correctly manages and distributes assets according to the individual’s wishes. Precise and law-binding language, in addition to a thorough understanding of the individual’s circumstance, is required to ensure that mistakes are avoided.

- An efficient estate plan achieves its goals while minimizing costs (e.g. professional fees, taxes, etc.), preserving privacy, and alleviating additional stress on loved ones.

Estate planning involves far more than just distributing one’s assets. It also entails selecting trusted individuals to oversee specific aspects of your estate, providing instructions for the professionals in your life to follow in your stead, and much more.

Common Estate Planning Documents:

- Powers Of Attorney (POA): Varying types of POAs grant varying levels of authority to the designated agent, also referred to as the person entrusted with the POA by the principal. POAs can be tailored to activate under specific conditions (“triggering events”), and the scope of decision-making authority can range from broad to narrow, as determined by the principal. It is crucial to appoint a trusted and reliable individual as a POA in any situation.

- Power of Attorney for Health Care: This document lays out the terms for medical decisions to be made if an individual becomes incapable of making them independently. This directive may designate a surrogate to act on behalf of the individual and specify preferences regarding permissible treatments, among other details. It is advisable to keep a record of one’s medical directives in a safe and accessible location, to be delivered to medical staff by a trusted individual(s) in case of emergency.

- Living Will: Provides direction to family members and medical professionals with regard to an individual’s wishes for life-prolonging care, treatment in the event of a terminal illness, end-stage care or persistent vegetative state circumstances. It provides clear and concise instruction to avoid uncertainty during an emotional time. This document goes hand in hand with a Healthcare Surrogate Designation

- Naming a guardian for children/dependents: Designating a guardian for dependents in your will is crucial for ensuring clear plans for their care, avoiding potential disputes, and ensuring they are raised according to your values. It allows you to choose a trusted individual to care for them, providing peace of mind and certainty for their future.

- Wills: By having a valid will in place, the deceased is said to pass “testate,” in which the intestacy laws of the state of domicile are avoided and personal property is instead distributed according to the decedent’s will. A will may contain a plethora of clauses added to the document, highly dependent upon the decedent’s unique situation.

- Trusts: This legal structure places assets in the care of a trustee, who is responsible for managing the asset(s) for the beneficiaries of the trust. Trusts can serve many purposes, such as the managing of assets in the event of incapacity, providing creditor protection, minimizing taxes, avoiding probate court (and avoiding publicity as a result), and more. Depending on the individual establishing the trust (“settlor”), different types of trusts should be considered during/afterlife and contain/omit certain provisions.

Trusts are often incorporated into estate planning, and when used correctly, can provide significant gift and estate tax savings. An example of a trust strategy used today takes the form of Spousal Lifetime Access Trusts (SLATs), which allow individuals with estates in excess of the post-TCJA (12/31/2025) estate tax exemption amounts ($5mm + TBD inflation adjustment) to remove assets from their taxable estate while still enjoying the ability to access these assets indirectly.

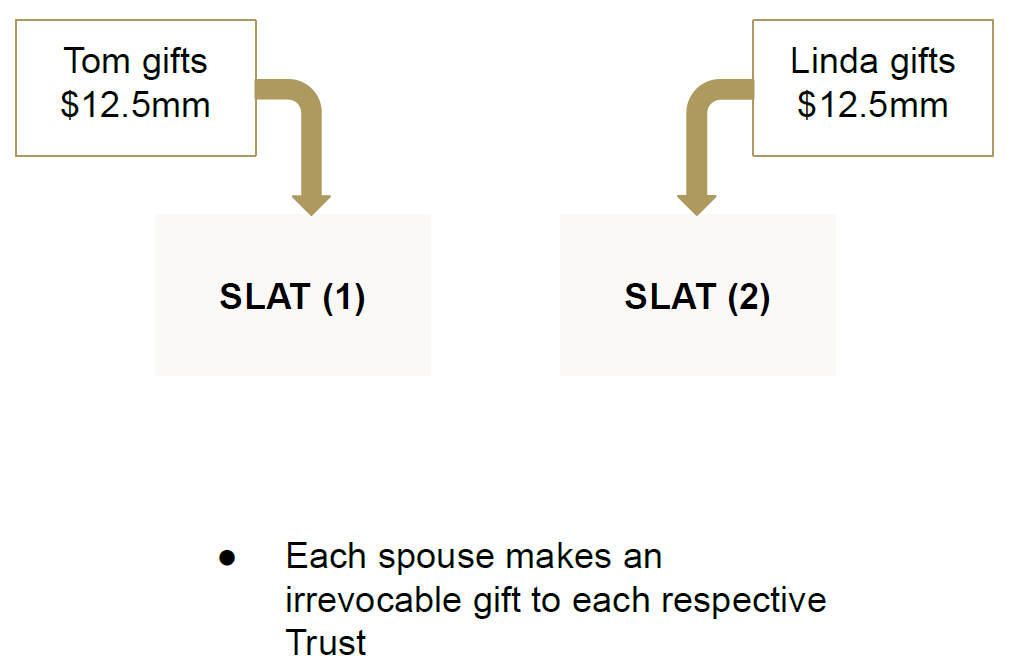

For example: Tom and Linda have combined assets of $25 million, and are concerned about the potential of the estate tax exemption shrinking to nearly half of its current amount in December of 2025 (estimated to be ~$7mm per spouse after adjusting for inflation). They want each other to have access to their assets during their lifetimes and leave the remainder to their three (3) children after the passing of the second spouse. In order to maximize their family’s use of the estate Tom and Linda have spent a lifetime accumulating, they will utilize SLATs to minimize estate taxes (estates in excess of the lifetime exemption amount face up to a 40% tax rate!). The SLATs must be setup in such a way to be eligible for estate tax avoidance, outlined below:

- Tom and Linda may gift up to $13.61mm each to respective SLATs (in the form of Irrevocable Trusts), though they will gift $12.5mm each in this example based on the size of their actual estate.

- Each spouse will name the other as the beneficiary of each respective trust, with the remainder beneficiaries set equally to their children.

- While each spouse technically “forfeits” access to any assets gifted to the trust, their spouse will have access to the trust and can simply use the gifted assets for their joint benefit or however he/she chooses.

- The SLATs cannot mirror one another, otherwise the IRS will disregard them altogether. To combat this, each SLAT should contain differing assets, gift dates, distribution terms, trustees, jurisdictions, etc. Which can be accomplished with a competent attorney.

- The Grantor (spouse who “creates” the trust) cannot act as Trustee, but can choose to name the other spouse as Trustee, or identify an independent Trustee (the latter is typically recommended as spousal Trustee’s may be limited in their access to the trust compared to an independent Trustee).

The result?

Tom and Linda are able to maintain their current lifestyle, set in place a gifting strategy for their children to enjoy the fruits of their labor after each has passed, while avoiding the potential for their current estate being subject to ~$4.4 million in estate taxes as of December 2025. Not to mention that while Tom and Linda’s estate may be valued at $25 million today, if any assets have the potential to appreciate, their estate tax liability may be far greater in the future.

*$4.4mm of estate taxes calculated as 40% of the $11mm above the estimated post-TCJA spousal combined estate tax exemption of $14mm

Considerations:

- A clause can be inserted in each SLAT, specifying that only the current spouse may be a trust beneficiary (to avoid concerns in the case of divorce), or that assets in the trust revert to the Grantor if the beneficiary spouse pre-deceases the Grantor.

- SLATs may provide loans to the Grantor if accompanied with a reasonable interest rate.

- Assets gifted to the SLAT do not receive a step-up-in-basis at the death of the Grantor, and instead receive a carry-over basis at the time the assets are gifted. The type of assets considered for the SLAT should be evaluated for each individual’s unique situation.

This is just one example of how Trust planning can provide value to a higher net worth individual(s), while there are many other strategies available to individual(s) to address concerns other than the lifetime estate tax exemption.

In conclusion, while estate planning may seem like a daunting and uncomfortable task, it is undeniably crucial for ensuring the protection of one’s assets and the well-being of their loved ones in the future. Crafting an estate plan that aligns with one’s values and goals provides comfort and safeguards against unforeseen circumstances. Our team is here to assist, whether you’re seeking guidance on an existing plan or starting the journey of estate planning anew, please do not hesitate to reach out with any questions or concerns.