Due to the SECURE Act 2.0 passed in 2023, more employers now allow employees to make Roth contributions to their retirement plans (401(k), 403(b), 457, SEP, SIMPLE, etc.). This change is driven by a new requirement for employees earning over $145,000 to make all age 50 catch-up contributions on a Roth basis, prompting many employers to add this option.

This begs the question for many participants – “Should my contributions be made as pre-tax or Roth?” The answer – as with most things related to financial planning – is that it depends. Some considerations to weigh up before settling on Roth contributions include:

- Current and future tax rates – do you expect your marginal tax rate to increase/decrease significantly in the next few years?

- Life expectancy – does chronic illness or hereditary illness have an impact on your life expectancy?

- Tax diversification – are your savings concentrated in a single account type?

- Estate planning goals – do you want to pass assets to your heir(s) efficiently?

These are just a few points to keep in mind when debating the pros and cons of contributing funds on a Roth basis.

Primary benefits of Roth assets:

- Tax-free growth over the account owner’s lifetime

- Tax-free asset transferred to account owner’s named beneficiary(s) – *Tax-free Required Minimum Distributions apply to non-spousal beneficiary(s)

- Significantly lower tax burden over account owner’s lifetime

The benefit of accumulating Roth assets is clear: Required Minimum Distributions (RMDs) are not required for the account owner, and any remaining funds passed to non-spousal beneficiaries are tax-free. For those with substantial assets in accounts subject to RMDs (like Traditional IRAs, pre-tax 401(k)s, 403(b)s, 457s, SIMPLEs, SEPs), RMDs can result in significant tax consequences.

Case Study Example

In order to highlight the value building assets inside of Roth accounts can truly add, let’s look at an example.

Tom & Linda:

Current Situation:

- Both 55 years old

- $500,000 saved in each of their pre-tax 401(k)s

- Current contributions are maximized each year for both

- Employer contributions of 3% each

- Earn combined annual income of $350,000 (inflation adjusted)

- Plan to retire at age 65 (2034)

Assumptions:

- Net of tax living expenses of $150,000 (inflation adjusted) stays consistent throughout their lifetimes

- Any savings leftover at the end of each year is spent

- Investments return average of ~7% annually

- Inflation averages 2.5% annually

- Life expectancy of 95 (plan ends in 2064)

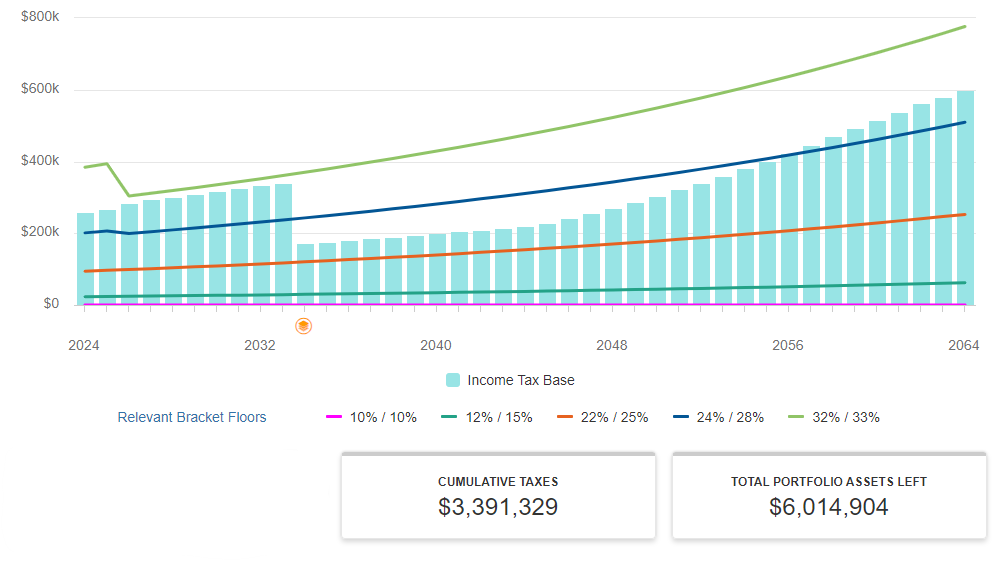

In their current scenario (pre-tax savings only), Tom and Linda will stay towards the top of the 24%/28% tax bracket until they retire in 2034, after which their income will come from portfolio withdrawals to cover living expenses. Their income increases in 2044 when they turn 75 and must start taking Required Minimum Distributions (RMDs). Their RMDs eventually exceed their income needs, pushing them unnecessarily into higher tax brackets. Over their lifetimes, their RMDs total about $6,691,238, leading to $3,391,329 in taxes from 2024-2064, with $6,014,904 in remaining assets.

*Relevant Bracket Floors assume reversion to previous marginal tax brackets post-TCJA

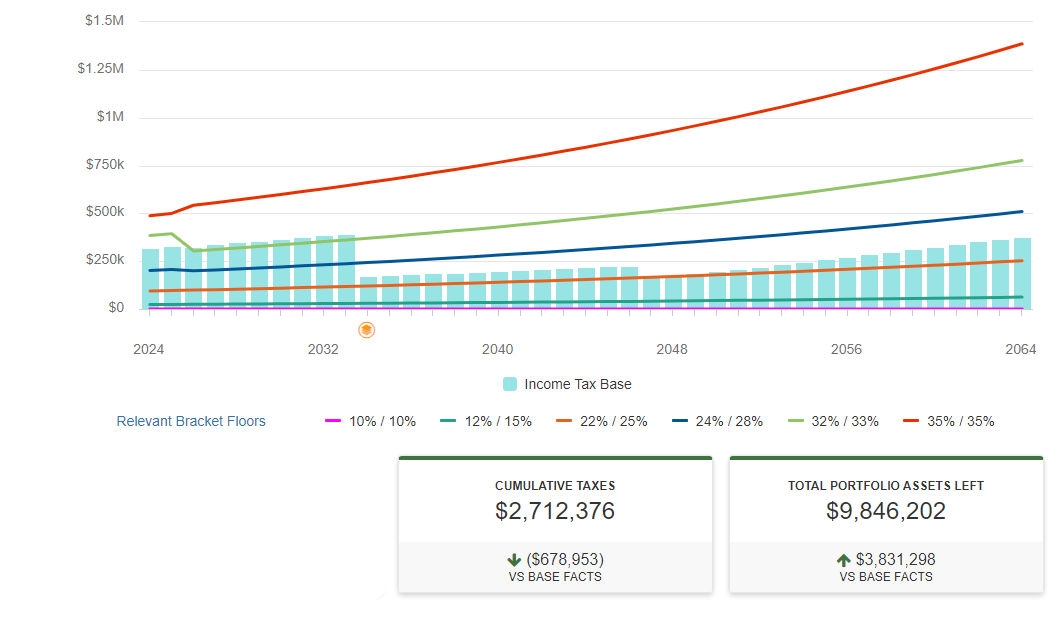

In the second scenario (Roth savings only), with all other assumptions remaining the same, Tom and Linda will cross over into the 32%/33% tax bracket during their working years. In this scenario the Y-axis has adjusted, showing the red 35% bracket (which is now relevant) as their pre-retirement income is higher due to Roth contributions being included in their income each year. However, post-retirement, their income never exceeds the blue 24%/28% tax bracket, which is much lower than in the previous scenario.

The Result:

In the second scenario, Tom and Linda save $678,953 in taxes over their lifetime and see an increase in the value of their portfolio of $3,831,298!

“How can the Roth contributions provide such an increase in their total portfolio assets left?”

This is due to avoiding RMDs on their Roth contributions. Instead of being forced by the IRS to withdraw assets, they can stay invested and enjoy ~40 years of tax-free growth. The compounding growth over this long period results in significant gains.

While it makes sense for Tom and Linda to consider switching their retirement contributions to Roth, this is a hypothetical example and may not yield the same outcome for others. Retirement plan contributions should be considered on a case-by-case basis, taking into account an individual(s) comprehensive financial picture.