One of the most common questions clients have as artificial intelligence continues to gain momentum is how to take advantage of it within their portfolio. Many investors are surprised to learn that it can actually…

Read More

Looking Ahead to 2026

Wow — 2025 flew by. It was a year that felt like one major headline after another, keeping markets on their toes. Despite the ups and downs, the year wrapped up with strong results across…

Read More

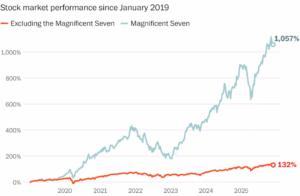

Is there an AI bubble?

The recent pullback in AI-linked stocks this November offered a helpful reminder of how quickly narratives can shift. Much of the market’s strength this year has been fueled by excitement and investment around AI, which…

Read More

Why Smart Investors Still Make Emotional Decisions

During our regular Spring and Fall progress meetings, current events often shape the questions that come up in conversation. This Fall, we’ve been hearing variations of the same questions: “Markets have been strong—are we due…

Read More

Should Gold Be Part of Your Investment Portfolio?

Gold has long been viewed as a timeless store of value, often rising in popularity when economic uncertainty or inflation concerns dominate the headlines. But what role should it play in an investment portfolio? While…

Read More

Is Dollar Cost Averaging “Better” Than Lump Sum Investing?

We often have clients who hesitate to invest when they believe the market is near a peak, worried that a downturn could cause immediate losses. One way to address that concern is through dollar cost…

Read More

April Newsletter | Volatility, Tariffs, and What Investors Should Do

If you’ve been watching the markets, you’ve likely felt the rollercoaster of economic shifts that have unfolded. From trade wars to heated debates about the size of the federal workforce, the first few months of…

Read More

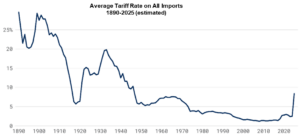

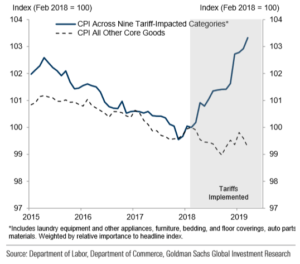

A Primer On Tariffs

With trade policy unsettling markets at the start of the second Trump administration, it’s important to understand tariffs—what they are, how they work, and the bigger economic and political effects they bring. While they can…

Read More

Year-In-Review | Fortress Wealth Planning

As we reflect on the past year, we are proud to share the growth our firm has experienced, a direct result of the trust and partnership we have built with each of you. Your confidence…

Read More

**Election Special** | Fortress Wealth Planning

As elections approach, speculation about their impact on financial markets intensifies. However, the election results are only one of many factors shaping market behavior, and short-term volatility often arises from a complex mix of economic…

Read More