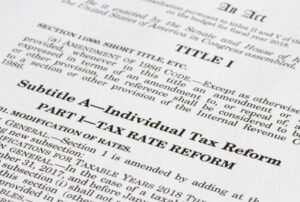

A whirlwind of new tax code has been introduced following the passage of the One Big Beautiful Bill Act on July 4th, 2025. We previously shared an overview of the key provisions expected to pass,…

Read More

June Newsletter | Tax Reform Update

On May 13, 2025, the House passed the The House Ways and Means Committee bill (One Big Beautiful Bill) commonly referred to as the “Tax Cuts and Jobs Act 2.0.” This legislation seeks to make…

Read More

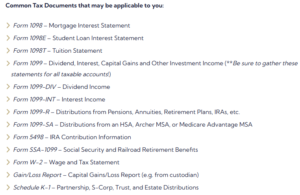

Tax Filing Considerations | Fortress Wealth Planning

As tax day approaches for those filing by April 15, it’s important to start preparing if you haven’t already—especially for those who won’t be filing extensions. Whether you’re self-filing or relying on a tax professional,…

Read More

Fortress Wealth Planning | Year-end Considerations

With year-end deadlines quickly approaching, now is the time to review your financial and tax strategies. To help you prepare, we’ve highlighted a few key items to consider before January 1st to ensure you’re making…

Read More

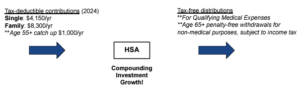

September Newsletter | Our Top 3 Underrated Planning Strategies

As we enter the final quarter of 2024, it’s a great time to explore some often-overlooked tax planning strategies. September and October are ideal for this, giving you a few months to implement these strategies…

Read More

Mitigating the Impact of the “Widow Tax”

Financial planners often use the term Widow Tax to describe the situation where a surviving spouse inherits tax-deferred retirement accounts from a deceased partner, potentially leading to a substantial tax burden. This issue primarily arises…

Read More

August 2024 Newsletter | 8 Key Themes to End 2024

As we enter the final weeks of summer, we wanted to share a concise update on eight key themes we’re currently focusing on in the financial markets, along with the strategies we’re implementing as we…

Read More

Are Roth 401(k) Contributions Worth it?

Due to the SECURE Act 2.0 passed in 2023, more employers now allow employees to make Roth contributions to their retirement plans (401(k), 403(b), 457, SEP, SIMPLE, etc.). This change is driven by a new…

Read More

Maximize your retirement savings with Post-tax contributions

Employees in both the private and public sectors have various options for saving for retirement. The most common retirement plans are 401(k)s, 403(b)s, and 457 plans, but others like SEP-IRAs and SIMPLE plans are also…

Read More

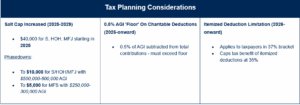

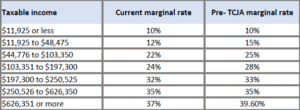

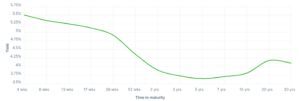

March 2024 Newsletter | Implications of a TCJA Sunset

The Tax Cuts and Jobs Act enacted under the Trump administration in 2017 brought with it major changes in the way of tax and other regulatory implications. As of now, TCJA is set to sunset…

Read More