On May 13, 2025, the House passed the The House Ways and Means Committee bill (One Big Beautiful Bill) commonly referred to as the “Tax Cuts and Jobs Act 2.0.” This legislation seeks to make permanent several key provisions from the original 2017 TCJA, while also introducing updates—some temporary, others permanent—to existing measures. In addition, the bill includes new tax-related provisions that could impact planning strategies moving forward.

This newsletter will outline some of the more pertinent proposals included in the bill, focusing on the changes most likely to affect individuals and businesses. While the legislation is still subject to revision as it moves through the Senate, understanding the key components now can help anticipate potential planning opportunities and challenges.

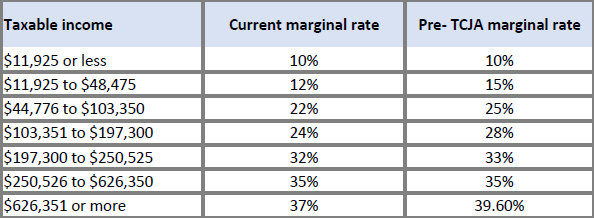

Permanent Change: Marginal Income Tax Brackets

The Tax Cuts and Jobs Act (TCJA) of 2017 enacted several key changes to the marginal tax brackets for individual income taxes. The House Ways and Means Committee Bill intends to make the current tax brackets permanent.

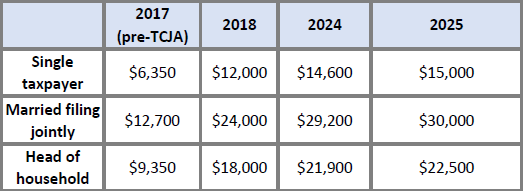

Permanent Change – With a Temporary Increase: Standard Deduction

The Tax Cuts and Jobs Act (TCJA) significantly increased the standard deduction starting in 2018, nearly doubling the previous amounts. Other changes are being proposed in the One Big Beautiful Bill, including:

Temporary additional deduction (2025-2028) Single: $1,000

Head of Household: $1,500 MFJ: $2,000

Temporary age 65+ “bonus” deduction (2025-2028)

$4,000 per individual or spouse age 65+ (Phased out based on Modified Adjusted Gross Income)

Permanent Change: SALT Cap Increased

One of the most debated aspects of the TCJA—the $10,000 cap on the State and Local Tax (SALT) deduction—remains a focus in the new House proposal. The bill would raise the cap to $40,000 (or $20,000 for married individuals filing separately), and from 2026 through 2033 the cap would rise by 1% annually, then remain fixed at the 2033 level for all following years. Additionally, the proposal introduces an income-based phaseout for taxpayers with AGI in excess of $500,000 ($250,000 for separate filers), with a minimum SALT deduction of

$10,000 ($5,000 for separate filers).

Other Changes:

Permanent Change: Itemized Deductions

Mortgage interest indebtedness limits made permanent $750,000 of indebtedness

Home equity loans not eligible for deduction unless used to build or improve property Miscellaneous deductions permanently repealed

Temporary Change: Child Tax Credit

- Increase to $2,500 per qualifying child (0-16) from 2025-2028 (returns to $2,000 in 2029).

Permanent Change: Sec. 199A Deduction is made permanent.

- Qualified Business Income (QBI) deduction for sole proprietors, partnerships, LLCs, and S-corps. Increased limits starting in 2026

Permanent Change: Gift & Estate tax threshold

- The increased estate tax exemptions introduced by the Tax Cuts and Jobs Act (TCJA) in 2017 are currently temporary and scheduled to expire at the end of 2025. This would reduce the exemption from approximately $13.99 million per individual in 2025 to about $7 million in 2026.

- Under the One Big Beautiful bill, the estate tax exemption would be set at $15 million for single filers and $30 million for married couples, with adjustments for inflation.

Miscellaneous Temporary Changes:

“No Tax On Tips” (2025-2028)

- Available to non-highly compensated employees, whether or not a taxpayer itemizes their deductions. Occupation must “traditionally and customarily” receive tips as of 12/31/2024.

- Tips must be voluntary and not a condition of service provided.

“No Tax On Overtime” (2025-2028)

- Available to non-highly compensated employees, whether or not a taxpayer itemizes their deductions. Covers overtime earnings in excess of normal wage rate.

Auto Loan Interest Deduction (2025-2028)

- Up to $10,000 of “qualified passenger vehicle loan interest” New loans taken out/refinanced after 12/31/2024

- Includes: Cars, vans, SUVs, pickups, motorcycles, trailers, RVs, ATVs (must be assembled in USA)

- Income phaseouts apply.

Health Savings Account (HSA) Reforms (effective starting in 2026)

Maximum annual contribution amounts doubled

- 2026 Self-only: $4,400 ➡ $8,800

- 2026 Family: $8,750 ➡ $17,500

- Only available for individual contributions – employers cannot contribute beyond the current limit

- Medicare Part A enrollees age 65+ eligible to contribute

- Integration with Affordable Care Act coverage (Bronze & Catastrophic plans)

- Catch-up contributions by spouses to the same account.

In summary, the proposed House bill could still see changes before becoming law, especially as it moves through the Senate. Tax Law will keep evolving, and financial plans will continue to adjust with them. The goal remains the same: staying flexible and focused on the best outcomes for our clients, no matter how the landscape shifts.