Tariffs have become part of everyday conversation for anyone who glances at the news these days. Ever since the Trump Administration rolled out its tariff policy in April 2025, just about everyone — from economists to…

Read More

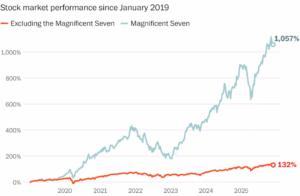

Artificial Intelligence: Is it in your portfolio? | February Newsletter

One of the most common questions clients have as artificial intelligence continues to gain momentum is how to take advantage of it within their portfolio. Many investors are surprised to learn that it can actually…

Read More

Looking Ahead to 2026 | January Newsletter

Wow — 2025 flew by. It was a year that felt like one major headline after another, keeping markets on their toes. Despite the ups and downs, the year wrapped up with strong results across…

Read More

Is there an AI bubble?

The recent pullback in AI-linked stocks this November offered a helpful reminder of how quickly narratives can shift. Much of the market’s strength this year has been fueled by excitement and investment around AI, which…

Read More

Why Smart Investors Still Make Emotional Decisions

During our regular Spring and Fall progress meetings, current events often shape the questions that come up in conversation. This Fall, we’ve been hearing variations of the same questions: “Markets have been strong—are we due…

Read More

Should Gold Be Part of Your Investment Portfolio?

Gold has long been viewed as a timeless store of value, often rising in popularity when economic uncertainty or inflation concerns dominate the headlines. But what role should it play in an investment portfolio? While…

Read More

Is Dollar Cost Averaging “Better” Than Lump Sum Investing?

We often have clients who hesitate to invest when they believe the market is near a peak, worried that a downturn could cause immediate losses. One way to address that concern is through dollar cost…

Read More

Short Video: Insurance Planning ☂️

Insurance can serve an important purpose when used to address specific needs, but it’s not a one-size-fits-all solution. In this video, we share how Fortress Wealth Planning approaches insurance within the context of a comprehensive financial…

Read More

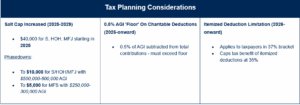

August Newsletter | Planning Strategies For The OBBBA

A whirlwind of new tax code has been introduced following the passage of the One Big Beautiful Bill Act on July 4th, 2025. We previously shared an overview of the key provisions expected to pass,…

Read More

July Newsletter | Assessing Crypto Through an Investment Lens

Cryptocurrencies continue to generate headlines and questions. This article takes a closer look at digital assets, specifically through the lens of investment strategy: how they fit (or don’t) within a well-diversified portfolio. The investment world…

Read More